Ministry may invest social security fund

Updated: 2011-10-26 07:55

By Li Xiang (China Daily)

|

|||||||||||

BEIJING - The Ministry of Human Resources and Social Security said on Tuesday that it is studying the feasibility of using the social security fund for market-based investment to gain a higher rate of return.

|

"Because the size of the fund is growing, we are facing increasing pressure to preserve and increase the value of the social security fund," Yin Chengji, the ministry's spokesman, said at a news briefing in Beijing.

"We are studying and making regulations on the investment of the social security fund," Yin said. "While we ensure the safety of the fund, we hope to gain a higher rate of return through investment."

Unlike the National Social Security Fund (NSSF), which the central government set up in 2000 as a strategic reserve for the aging population, the social security fund managed by the ministry can be invested only in treasury bonds and bank deposits under the current regulations.

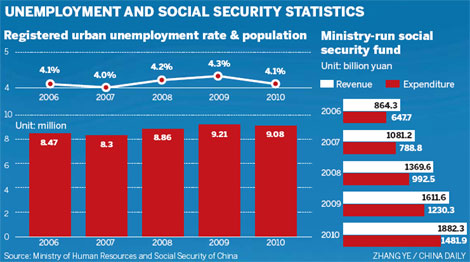

The social security fund, comprising insurance for pensions, healthcare, unemployment, work injury and maternity for urban workers, stood at 2.39 trillion yuan ($375.7 billion) as of the end of 2010, according to the ministry.

During the first three quarters of 2011, revenues of the social security fund climbed 26.9 percent year-on-year to 1.64 trillion yuan while its total expenditures increased 21.2 percent to 1.29 trillion yuan, Yin said.

Zhang Qi, an analyst at Haitong Securities Co Ltd, said that allowing the country's social security fund to be invested in the capital market will help maintain the value of the fund given the current high inflation rate.

|

"It is necessary for the fund to find other investment products to preserve its value, for the real interest rate is negative," Zhang said, adding that the move would also help broaden the channel for direct financing in the capital market.

Analysts said that the social security fund should be invested in low-risk products that offer stable returns in the long run, because the main purpose of the investment is to stay ahead of rising inflation so the fund will maintain its value.

Meanwhile, the Ministry of Human Resources and Social Security said that the economic slowdown has not had a major impact on the job market.

China created 9.94 million new jobs from January through September, exceeding its target of 9 million jobs this year. The registered urban unemployment rate was 4.1 percent at the end of September, according to the ministry.

"The ministry is closely monitoring the country's economic development and will adopt targeted measures to maintain stability in the job market," Yin said.

The government will intensify efforts to boost employment for the rest of the year by introducing more favorable tax policies and extending additional financial support, he added.

Hot Topics

New sex education textbooks were introduced to pupils in Shanghai on Monday after numerous debates on early-age sex education in China.

Editor's Picks

|

|

|

|

|

|