|

|

A father and his daughter take part in the riddle-guessing contest at a KFC outlet in Zhengzhou, capital of Henan province, during this year's Lantern Festival. [Photo/China Daily] |

CIC says 2015 performance hurt by slumping oil and iron ore prices, foreign exchange losses

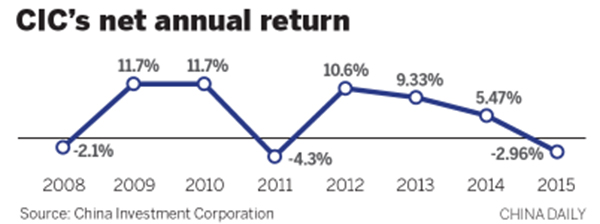

China Investment Corporation announced on Friday that its overseas investments generated a net return of negative 2.96 percent in dollar terms in 2015, falling from a positive 5.47 percent return for 2014, due to volatilities in international financial markets and foreign exchange losses triggered by an appreciating dollar.

The $814 billion Chinese sovereign wealth fund posted a net cumulative annualized return of 4.58 percent since its establishment in September 2007, compared with 5.66 percent in 2014.

CIC spokeswoman Liu Fangyu said the performance last year was hurt by plunging commodity prices, which had a big impact on certain direct investment projects. In 2015, the Goldman Sachs Commodity Index fell 32.86 percent, as oil prices slumped 36.28 percent and iron ore prices dropped 37.37 percent.

Liu said another factor was the negative interest rate policy implemented by some countries, which led to lower-than-expected investment returns on bonds and equities. Last year the Morgan Stanley Capital International Index dropped 2.36 percent. In the emerging markets, equities fell 14.86 percent and bonds declined 11.15 percent.

The spokeswoman said a third driver was that the fund's financial performance was denominated in dollars and the greenback appreciated 9.26 percent last year, triggering foreign exchange losses of $3.77 billion for CIC.

"We estimate that the appreciation of the dollar will continue to affect our performance this year," said Li Wenping, managing director of CIC's department of finance and accounting.

At the end of December, the fund said that public equities took up 47.47 percent of its global investment portfolio, followed by long-term investments (22.16 percent), fixed-income investments (14.44 percent), absolute returns (12.67 percent), and cash and others (3.26 percent).

The Chinese sovereign wealth fund said it has stepped up investments in assets with stable returns, including infrastructure and real estate.

Last year, CIC Capital Corporation completed the acquisition of a minority interest in Autobahn Tank & Rast Holding, a German motorway service area operator. CIC Capital and two other companies also acquired about 65 percent of stake in Kumport, the third-biggest container port in Turkey, through a jointly established special purpose company.

"We'll increase our long-term investments and pay more attention to investment opportunities associated with China's economic transition and the development of high technology," said Liu.