|

|

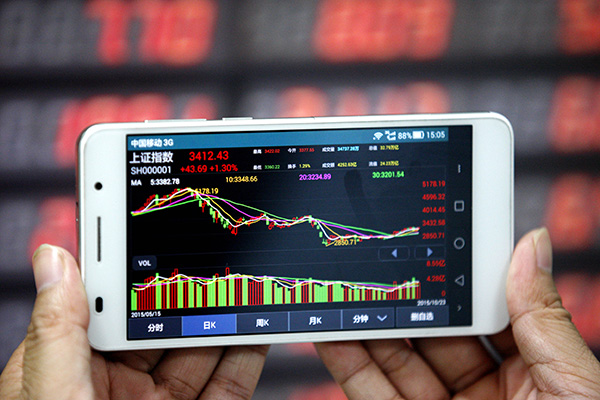

A stock indicator shows the benchmark Shanghai Composite Index on Oct 24, 2015. [Photo by Xie Zhengyi/Asianewsphoto] |

The executive chairman of Templeton Emerging Markets Group predicts China's "new economy" sectors will drive growth as the nation weans itself from a reliance on credit-fueled investment. The problem, Mobius says, is that many stock valuations have already reflected a successful transition.

The ChiNext Index-used by local traders as a proxy for new economy companies-is three times more expensive than the benchmark Shanghai Composite Index after surging 25 percent in the past month.

While the rally signals investor confidence in a government roadmap projected to highlight new economy sectors this week, Mobius says the gains are reminiscent of the United States dot-com boom in 2000. Back then, predictions that the Internet would boost productivity and upend industries from media to retailing have proved accurate. Yet investors who plowed into the Nasdaq Composite Index shares near their peak had to wait 15 years to recoup losses after the bubble burst.

"We are facing a little bit of what we faced in 2000, in the sense of some people getting too excited about certain kinds of companies, certain kinds of mandates, and we need to be cautious," said Mobius, whose $1.2 billion Templeton Asian Smaller Companies Fund has outperformed 85 percent of peers tracked by Bloomberg in the past five years. "The transition is definitely on its way and is going to be successful. It doesn't mean that all the companies will be successful."

The ChiNext-which has some of its biggest weightings in Internet, industrial automation, environmental protection and media companies-is valued at 41 times projected earnings over the next 12 months. That compared with multiples of 13 for the Shanghai Composite Index and 20 for the Nasdaq, which is dominated by technology firms including Apple Inc and Amazon.com Inc.

Even among China's biggest companies, new economy industries are leading gains as the stock market rebounds from a four-month selloff. "The new economy stocks are way too expensive, way too overbought," Hong Hao, the chief China strategist at BOCOM International Holdings Co, said in an interview on Friday.