|

|

Investors look downcast at a stock trading center in Fuyang, Anhui province. [Photo/China Daily] |

Whether recent market performance marks the beginning of the end or the end of the beginning of a long bull is a question among most A-share investors.

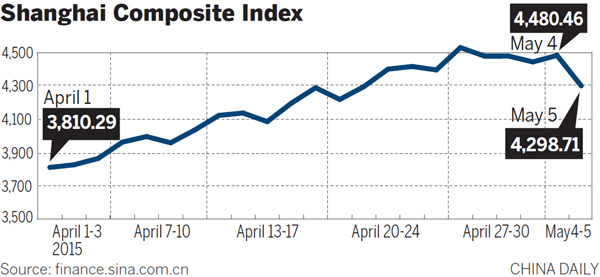

Earlier this week, the market was surprised to see a halt to its year-long bullish trend, as its benchmark Shanghai index lost 8 percent. Despite the three-day losing streak, the gauge has jumped 70 percent in the past six months.

The Shanghai Composite Index bounced back 2.3 percent on Friday, closing at 4,205.92 points, while the Shenzhen Component Index advanced 2.6 percent to 14,481.25. Internet, healthcare, logistic and home appliance stocks led the gains.

Market adjustment is underway, with increasing volatility expected, said analysts.

As Shanghai index has reached 4,200 points and positive news flow such as an interest rate cut may have been exhausted in the near term, the market will enter a correction phase, said Hong Hao, chief China strategist of Bocom International Holdings, in a note on Wednesday.

"Expensive valuation, euphoric sentiment and slowing liquidity from margin lending expansion will challenge the market in the near term," said the Hong Kong-based strategist.

Morgan Stanley downgraded Chinese equities on Thursday for the first time in more than seven years due to valuation concerns. The institution lowered its rating from overweight to equal-weight on the MSCI China Index.

The Shanghai Composite Index ended the week with a 5.3 percent or 235.7-points decline.