|

|

Oil and gas consumption is expected to see slower growth in China this year, with the falling global crude prices providing an opportunity for more energy sector reforms, experts said on Wednesday.

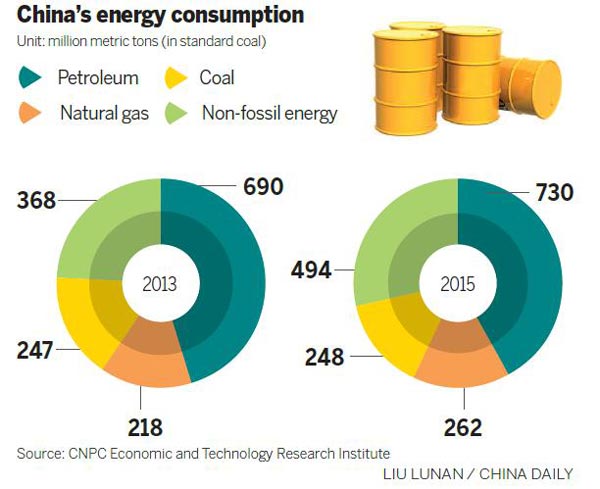

The country's oil demand will grow 3 percent year-on-year to 534 million metric tons in 2015, according to the think tank of China National Petroleum Corp, the nation's top oil and gas producer. In 2014, oil consumption grew by 3.3 percent to 516 million tons, said a report published by the CNPC Economic and Technology Research Institute.

"Economic incentives for oil consumption will continue to decline. As a result, China's oil demand growth will be slower, at around 2 to 3 percent in the future," said Sun Xiansheng, head of the institute.

The think tank estimated the average price of global crude benchmark Brent to be around $60 to $70 a barrel and the West Texas Intermediate crude price at about $55 to $65 a barrel this year.

Affected by a supply glut and weakening demand, global crude prices had dropped from around $115 a barrel in mid-June to $53 a barrel by the end of 2014. Prices continued to decline to below $50 a barrel this month.

"From a trading perspective, China will have a much bigger say in the international crude market since the country, as a strategic buyer, will keep leading the demand growth in the world," Sun said.

He said crude output may gradually decline as international oil companies cut investment this year to cope with price drops.

"Low-cost crude producers such as in the Middle East region will gain a much bigger market share," he said. "China will be a buyer that all the producers want to chase."

Wang Zhen, deputy director of CNPC policy research office, said Chinese oil companies should use the falling crude prices to adjust their business structure so that China can accelerate the reform of the energy industry.

Yang Lei, deputy director of the oil and natural gas division at the National Energy Administration, said falling crude prices have triggered losses for many overseas oil blocks owned by Chinese firms.