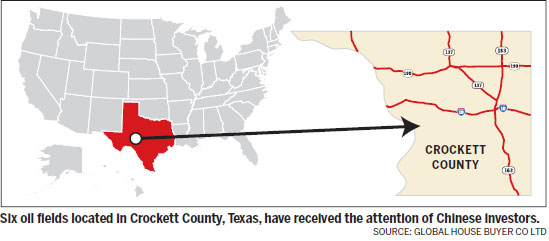

Oil-price drop spurs Chinese to invest in Texas oilfields

After attending an introduction meeting in Beijing, He Xiaohua decided to invest in an acquisition project for five oilfields in Texas.

Even though the Chinese investor has two decades of investment experience, he had never thought of buying foreign oil wells. But he believes now is the right time.

"The oil price has been quite close to the bottom and it will rebound sooner in several months," he told China Daily on Jan 17.

His said his speculation is based on a lecture given by Global House Buyer Co Ltd (GHB), a Beijing-based agent company that helps its clients - mostly wealthy Chinese - buy property overseas. It's also the first time that the company, which has businesses in 15 countries, has introduced investments in oilfields to its clients.

"For many Chinese, buying oilfields overseas remains a kind of mysterious investment, and actually, it's similar to buying houses in foreign countries," said Liu Bin, a senior manager of GHB who is in charge of the oilfields program. "The company's mission is to manage properties overseas for our clients, and there are many different forms of properties, including energy."

Foreign investment in the energy industry is welcomed by the US government, and the biggest risk for investors now is the slump of oil prices.

"It has already jumped from $130 to the current $40 (a barrel), and we are sure that it's an excellent investment program," he said.

According to Liu, the management team of the oilfields project - consisting of experienced American investors including a former senior manager from Mobil - has bought five oilfields in Texas for a total of $8 million. The oilfields, already in production since 2012, were acquired from an Australian company that could not sustain operations due to a money shortage.

Half of the funds, $4 million, are divided into 40 units on average for Chinese investors to buy. After buying the shares, the investors will get an annual payment of 15 percent of their investment for three years, and the reward would be paid seasonally, according to the program.

"Chinese economic growth has slowed down, and it's a good alternative for the investors to get an annual reward of 15 percent through buying property in the US," Liu said.

Raymond Gerald Bailey, who has extensive experience with big oil companies in the Middle East, said that the increasing demand of booming economies like China and India will support the rise of oil prices.

"We have tremendous need of oil. Right now the world is increasing its energy need by something like 2 percent for a year," he added. "Oil is the basis for many products."

Crude oil prices are influenced by many factors, both economical and geopolitical around the world, but over the past 100 years, the trend has generally been up, he said.

Liu, the senior manager of GHB, said that the current oil price slump is caused by political reasons rather than the market supply and demand.

"If the supply has surplus the demand, the crude oil prices should go downward in a gradual manner, but now it is like jumping from a cliff," he said.

The company will introduce more oilfields investment programs sooner this year if the first round of investment proves to be profitable, he added.

For He Xiaohua, the Chinese investor, spending $100,000 for an American oilfield is an experiment that is worth to risk.

"After all, it's not a big sum of money, and I want to have my properties multiplied," he said.

anbaijie@chinadaily.com.cn