Energy consulting firm Wood Mackenzie estimated in late January that global natural gas demand in the transport sector will grow from nearly 40 billion cu m in 2012 to more than 160 billion cu m in 2030.

"The most striking thing is the growth of LNG demand associated with the transport sector, increasing from less than 5 billion cu m in 2012 to more than 80 billion cu m in 2030 and increasing from less than 1 percent to some 10 percent of global LNG demand," according to Wood Mackenzie.

"China will remain the single largest market for gas in transport, with consumption of 45 billion cubic meters by 2030," said Noel Tomnay, head of global gas research for Wood Mackenzie.

"Demand in China is being propelled by a combination of winning factors," Tomnay said. That include strong vehicle market growth and financial support from regional governments.

These trends are driving up China's LNG imports and the number of LNG receiving terminals in the country.

As of the end of 2013, China had 10 terminals in operation with an annual capacity of 32.3 million metric tons, according to ICIS C1. It forecast that the nation's annual capacity will grow to 37.3 million tons in 2014, with two new terminals going into operation.

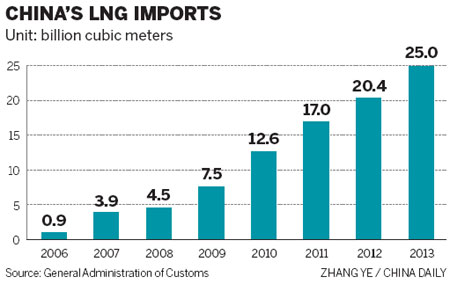

In 2013, China's LNG imports rose 22.4 percent to 25 billion cu m, according to the CNPC institute.

In the downstream sector, China is building more LNG fueling stations because the number of LNG-powered vehicles is increasing.

According to ICIS C1, China will build more than 400 LNG stations this year and the country will have about 2,500 stations by year-end.

From 2009 to 2011, supply shortages and technology constraints limited the growth of LNG stations in China.

As the problems were resolved, the number of LNG stations more than doubled in 2012 and grew 130 percent in 2013.