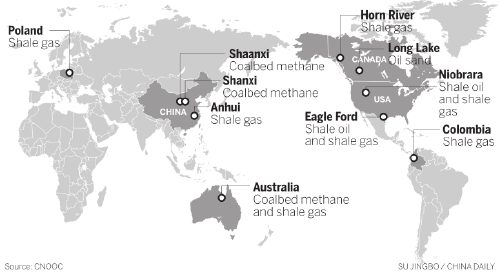

CNOOC's global unconventional oil and gas assets

Chinese fuel developer going abroad to secure more natural gas sources

Responding to soaring natural gas demand and the government's increasing focus on environmental protection, China's top energy players are stepping up exploration overseas.

CNOOC Ltd, the country's largest offshore oil and gas developer, announced on Wednesday that its wholly owned subsidiary, Nexen Energy Inc, has entered into an exclusive agreement with British Columbia, Canada, to examine the viability of constructing a liquefied natural gas plant and export terminal.

It's the latest move by Chinese companies to get access to overseas natural gas resources, pressured by severe domestic shortages.

"From a long-term perspective, CNOOC's LNG project will give [China] a bigger voice in LNG prices," said Wang Xiaokun, an analyst at commodity consultancy Sublime China Information Co.

East Asian LNG importers have long paid high prices. At peak seasons, LNG import prices in the region can reach $20 per million British thermal units, compared with $3 to $4 in the United States, said Wang.

"If we establish LNG plants and export terminals overseas and deliver the fuel directly back to China, prices will fall to a reasonable level," she said.

The proposed project will be located near Prince Rupert, BC.

"LNG exports are the most attractive option for maximizing the value of our Canadian shale gas business," said Li Fanrong, chief executive officer of CNOOC.

The project has good potential to supply resources at a relatively lower cost.