|

|

|

|

|||||||||||

|

|

Despite unprecedented opportunities abroad, China's outbound direct investment is still in a fledgling state, according to a poll undertaken by China's trade promotion agency.

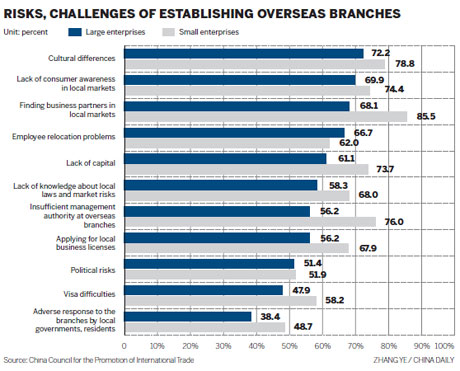

A majority of the companies that responded to the survey, entitled Chinese Companies' Outbound Investment and Operation, said they were dissatisfied with the way business is conducted overseas, where economic, cultural and political difficulties abound.

Responding to opportunities abroad, Chinese companies have been extending their reach to more countries in Africa, Europe, North America and Latin America, as well as in Asia. More than half of the respondents to the survey, though, said they were not satisfied with the profits their overseas branches and operations make or the market shares that they hold.

A majority also said their businesses were doing better in Africa than in the United States and the European Union. They attributed their good African fortunes to the improved infrastructure and tamer competition on that continent, the survey said.

The China Council for the Promotion of International Trade published the results of the poll, which drew on interviews held with more than 1,000 outward-oriented Chinese companies hailing from 16 cities across the country.

"China's outbound direct investment is still at an early stage, and Chinese companies aspiring to invest abroad will have to face and deal with all sorts of difficulties," said Dong Jiayang, director-general of the economic information department of the council.

Of the companies surveyed, most said the overseas investments were made during the past five years. Only 3 percent said their overseas operations were established 10 years ago, the survey said.

Among the overseas projects undertaken by the companies surveyed, 70 percent were new, and 20 percent were done through joint ventures. The remaining 10 percent were made through mergers and acquisitions, it said.

"Chinese companies and their foreign counterparts should improve their understanding before undertaking acquisitions," said Robin Bew, chief economist at the research organization The Economist Intelligence Unit.

"One fruitful approach is to first form joint ventures or partnerships as a way of showing good intention."

Also in the survey, 56 percent of the respondents said they know a lot about the foreign markets where they do business.

"China is still a latecomer in outbound direct investment, and domestic companies aren't strong enough competitors," said Kong Linglong, director of the department of foreign capital and overseas investment of the National Development and Reform Commission.

China's outbound direct investment increased annually by double-digit percentages from 2006 to 2010 and is expected to continue surging as the Chinese government encourages businesses of all types to invest abroad.

By the end of 2011, China's cumulative investment in the United Kingdom reached $2.3 billion. Half of that was made in 2011 alone, said Wu Kegang, director of the UK China Business Chamber Ltd.

Some Westerners look askance at China's outbound investment, saying the country is merely going after resources abroad. The survey offered evidence to the contrary, showing that 66 percent of the interviewees were mainly involved in production and sales abroad; 58 percent in providing maintenance and after-sales services; and 54 percent in branding.

"China aims to tap the overseas market rather than grabbing natural or mining resources," Dong said.

In 2011, China made the fifth-largest amount of investment in the world, surpassing Japan and the United Kingdom. By the end of 2011, China's cumulative amount of outbound investment was more than $380 billion.