|

|

|

|

|||||||||||

Investment growth rate to decline by more than half: senior researcher

The yuan will be under increasing downward pressure in 2012, and the increase in yuan holdings for foreign exchange purchases and the investment growth rate will both decline by more than half, a senior researcher close to the authorities said on Wednesday.

Liu Yuhui, director of the financial laboratory at the Institute of Finance & Banking at the Chinese Academy of Social Sciences, a prominent central government think tank, said he had obtained these forecasts from the central bank.

|

"Domestic and external conditions for yuan appreciation have changed dramatically compared with the past 10 years, leaving more room for two-way yuan fluctuation, instead of only appreciation."

Regarding external conditions, he said although yuan holdings in January had increased, the growth for each month will decline to somewhere below 150 billion yuan ($23.7 billion) in 2012, in contrast with 250 billion to 300 billion yuan in the past five years.

For 2012, the total increase in yuan holdings will shrink to 1.5 trillion yuan, compared with an average of 3 trillion yuan in the past five years.

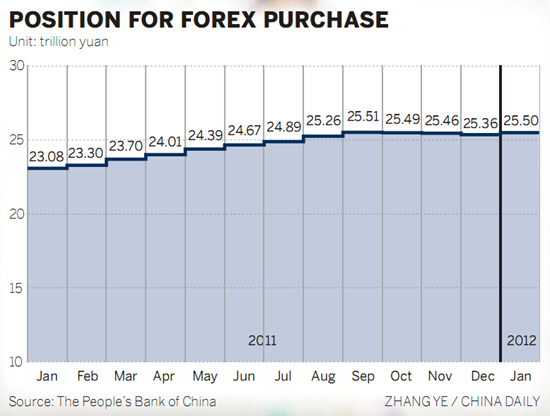

Banks' holdings for purchasing foreign exchange, an indicator of capital flows, fell for the first time in four years in October by 25 billion yuan.

Holdings declined again in November by 28 billion yuan, and again in December by an even larger 100 billion yuan.

In January, however, holdings rose nearly 141 billion yuan.

The domestic situation was also changing, he said, as the past pattern of fiscal expansion will not continue.

"In that respect, the change will be reflected in a dive in the investment growth rate, which will drop to about 12 percent - the level when (former premier) Zhu Rongji led the cabinet - from about 23 percent in recent years," Liu said.

Judging by figures for new yuan loans by banks, which have been running below expectations, the tendency was very clear, he said.

Despite these trends and changes, he said, the yuan might not depreciate this year. The central bank will use its dollar holdings to support the currency if necessary, he said.

China recorded the biggest trade deficit in 22 years in February, and the slowest increase in January-February industrial output since 2009, according to data released by the Ministry of Commerce and National Bureau of Statistics last week.

Premier Wen Jiabao told a news conference on Wednesday that the yuan might have already reached an "equilibrium" level, judging by the trading situation in Hong Kong since September, and Wen said the government will allow relatively greater two-way fluctuation in the currency.

The yuan fell to the lowest level in more than seven weeks on Wednesday as the central bank set its reference rate against the dollar 0.1 percent weaker at 6.3328. The yuan dropped 0.1 percent to 6.3323 per dollar in Shanghai, the weakest since Jan 30. The currency has depreciated 0.3 percent so far this week, according to data compiled by Bloomberg.

A survey released on March 12 by Standard Chartered Bank (China) Ltd looked at Hong Kong manufacturers based in the Pearl River Delta area, and found that nearly half of the 204 respondents expected the yuan will appreciate 3 to 5 percent this year against the dollar.

wangxiaotian@chinadaily.com.cn