Outbound M&A hits record high, says PwC report

Updated: 2012-01-14 09:21

By Hu Yuanyuan (China Daily)

|

|||||||||||

BEIJING - Chinese outbound merger and acquisition (M&A) deals reached a record high of $42.9 billion in 2011, an increase of 12 percent year-on-year, despite the global economic slowdown, according to the accountancy company PricewaterhouseCoopers LLP (PwC) on Friday.

A total of 207 outbound M&A deals were signed last year, up 10 percent from 2010.

"Those figures indicate that Chinese investors' appetite for deals is stronger than ever, across a wide range of industries and geographical locations," said Leon Qian, PwC China's Transaction Services Partner.

The strong growth in outbound deals also pushed the country's overall M&A activity up by 5 percent to 5,364 deals, the highest-ever annual total. Domestic deals climbed 11 percent to 3,262.

"Despite the global macroeconomic climate, confidence among investors looking for M&A deals both within China and abroad remains surprisingly robust," Qian added.

As China moves into a new phase, M&A is emerging as a key enabler of consolidation, growth, market positioning and the acquisition of strategic assets and expertise.

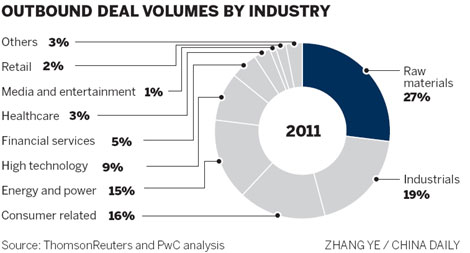

There were 16 outbound M&A deals valued at more than $1 billion by Chinese buyers last year, compared with 12 in 2010. Fourteen of those deals were in the resources and energy sectors.

"Chinese buyers now attach more attention to M&A opportunities in the industrial-products sectors, reflecting the country's gradual shift to a consumer-driven economy," said Edwin Wong, PwC China's International Tax Services Leader

The sluggish global economy, however, is affecting foreign M&A buyers wanting to make a strategic purchase in China, PwC said in the report.

Economic uncertainties in home markets led to an 11 percent decline in foreign M&A activity in China to 482 deals, falling most notably in the second half of last year after a rebound in 2010.

Meanwhile, private equity (PE) is emerging as a key provider of growth capital for China's small and medium-sized enterprises, as they aim to expand despite challenges in raising funds amid fiscal tightening and uncertainty in the equity markets.

The number of larger PE deals (those exceeding $10 million) increased by 18 percent to 437 transactions in 2011 - the highest number ever, according to the PwC report.

Private-equity fundraising also reached a record high in 2011, totaling $44.1 billion for investment in China. Yuan-denominated funds accounted for 60 percent of the total, continuing the trend of the previous two years.

"A key trend is the expansion of the domestic Chinese PE industry; there are now many domestic players who can compare advantageously to their better-known global peers," said Qian.