Net profits increase 14.2 percent for Jan-Sept period after 2012 losses

Corporate conditions brightened broadly in the third quarter as the economy improved, but analysts warned that the benefits of an improved macroeconomic climate may soon wane.

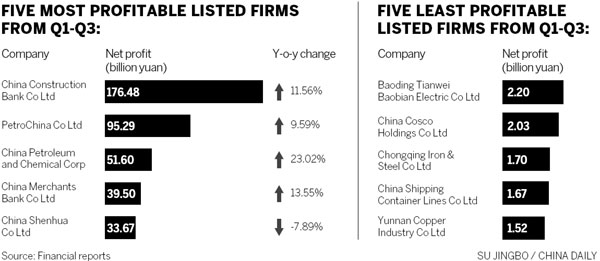

The net profits of 2,489 listed companies jumped 14.2 percent year-on-year in the first nine months, a sharp turnaround from the 1.1 percent decline for that period in 2012, according to calculations by the Shanghai Securities Journal.

For many companies, the third quarter was the best so far this year.

Excluding financial institutions and oil giants PetroChina Co Ltd and China Petroleum and Chemical Corp, listed companies' aggregate net profits hit 205.5 billion yuan ($33.4 billion) in the third quarter, up 25 percent year-on-year.

Fifteen of 20 listed steel manufacturers turned a profit in the third quarter as they benefited from accelerating economic growth and government support.

Lifted by strong third-quarter sales, Wuhan Iron & Steel Group and Shagang Group achieved net profits of 651 million yuan (up 98.4 percent) and 14.9 million yuan (up 251.6 percent), respectively, in the first nine months.

"Traditional industries will receive more of the dividends of reform," said Qin Hong, chief analyst of Jiangsu-based Golden Lark Investment. "The move to market-based energy prices, including oil prices, and the opening up of the railway sector are acting as catalysts for related industries.

"Trading volume of these companies' shares is also active," said Qin.

In emerging industries such as film production and mobile phone games, the performances were more polarized. Corrections are due for some overvalued shares, he said.

China's biggest automaker - SAIC Motor Corp - beat expectations with a 23 percent rise in third-quarter profit to 6.5 billion yuan, helped by robust sales at joint ventures with General Motors Co and Volkswagen AG.

SAIC made a net profit of 18 billion yuan during the January-September period, compared with 16.1 billion yuan a year earlier, the Shanghai-based automaker said in a filing to the Shanghai Stock Exchange.