FDI registers another drop in Dec

Updated: 2012-01-19 09:12

By Zhou Siyu (China Daily)

|

|||||||||||

Fragile world economic recovery and increasing labor costs blamed

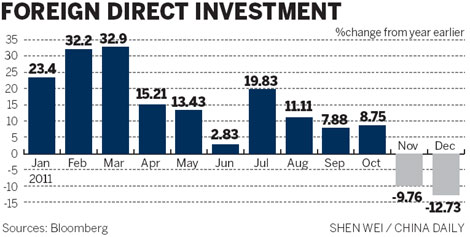

BEIJING - Foreign direct investment (FDI) in China registered the sharpest year-on-year decline in December since August 2009, when the country was hit by the global financial crisis, the Ministry of Commerce said on Wednesday.

Officials and analysts attributed the slowdown to a fragile recovery for the world economy and increasing labor costs.

Yet they still believed China will maintain stable FDI growth in the future as the country continues to open up its market and improve its investment environment.

FDI in China declined by 12.73 percent in December from the year before, the second month in a row that had seen such a decrease, the ministry said.

In 2011, the country's total amount of FDI reached a new high of $116 billion but its growth rate slowed to 9.72 percent from 17.4 percent in 2010, according to the ministry.

Investment from the United States decreased by 26.1 percent in 2011 to $3 billion, while that from the European Union decreased by 3.65 percent to $6.3 billion, the ministry said.

"China's FDI increase in 2011 was one of the lowest in recent years," said Shen Danyang, a ministry spokesman.

He said the slowdown was mainly the result of a sluggish economic recovery in the US, the European Union and other developed economies, which has prompted investors to hold back.

In the meantime, foreign direct investment in the Chinese service industry outstripped the manufacturing industry for the first time, making up 47.6 percent of the total investment recorded in 2011, the ministry said.

"Pushed by a stronger yuan, China's labor costs have been increasing in recent years," said Lu Zhengwei, an economist with the Industrial Bank Co Ltd.

"This may squeeze the manufacturers' profits and pose difficulties to attracting FDI to the manufacturing sector."

Nevertheless, analysts said China still has the potential to retain its position as the most attractive place to invest in.

Huo Jianguo, president of the Chinese Academy of International Trade and Economic Cooperation, a think tank of the Ministry of Commerce, said the country should continue opening up its service industry to foreign investors.

China has improved its FDI structure with more investments flowing into the service industry. A more open service industry, along with improving investment opportunities in the western parts of China, will help the country maintain stable FDI growth, Huo said.

The value of China's outbound investment in 2011 stood at $60 billion, an increase of 1.8 percent from the year before - much lower than the growth rate of 36.3 percent recorded for 2010, the ministry said.

Pressed by the dismal world economy, countries have increasingly begun to take protective measures against investments by China's State-owned enterprises, Shen said, citing a report by the United Nations Conference on Trade and Development.

Investment outflows to the European Union jumped by 94.1 percent in 2011 to hit $4.3 billion and those to Africa increased by 58.9 percent from 2010 to hit $1.7 billion, according to the ministry.

Huo said the eurozone's debt crisis might provide an opportunity to bring about more cooperation among Chinese and European companies.

"The world has now reached a consensus: If we are to overcome the current global economic stasis, we must cooperate," Huo said.

This will provide an opportunity for Chinese companies to invest abroad, especially in the European Union, he said.

Related Stories

FDI slows to 9% 2012-01-06 08:01

Serving the nation's future 2012-01-06 09:21

China Economy by Numbers - Dec 2012-01-17 15:55

First FDI drop in 28 months 2011-12-16 08:08

- FDI registers another drop in Dec

- Closer trade relations benefit both

- China's non-financial ODI totals $60.07b

- Profits of China's State firms grow 12.8%

- Chinese banks short of cash ahead of holiday

- Property prices drop in more cities in Dec

- China's social financing shrinks in 2011

- Disney brings famous character brands to China