China can soften global shocks

Updated: 2011-10-14 09:35

(China Daily)

|

|||||||||||

|

The headquarters of the International Monetary Fund in Washington DC. The organization warned that near-term risks to Asian economies are "decidedly" rising, requiring regional policymakers to be nimble and prepared to reverse course rapidly. [Photo/Bloomberg] |

IMF's regional head says nation must help as outlook worsens

TOKYO - China has the scope to shield its economy from global risks and Beijing's response would help soften the effects if Europe's debt woes and faltering US growth escalate into a global crisis, a senior International Monetary Fund (IMF) official said on Thursday.

Anoop Singh, head of the IMF's Asia and Pacific department, suggested it was also the responsibility of the world's second-biggest economy and other export-reliant economies to help rebalance the global economy by strengthening domestic sources of growth.

China "has the scope to respond" should downside risks to the global economy materialize, Singh said. "What's important to notice is that even China's response would only offset a part of the shock. It could not offset the entire shock."

Singh was presenting the IMF's outlook for the Asia-Pacific region, which warned that near-term risks to Asian economies are "decidedly" rising, requiring policymakers to be nimble and prepared to reverse course rapidly.

In its twice-yearly Asia and Pacific Regional Economic Outlook, the IMF warned that risks for the region are "decidedly tilted to the downside".

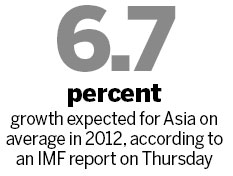

The IMF expects growth of 6.3 percent in 2011 and 6.7 percent in 2012 for Asia on average, slightly below its April forecast of 6.8 percent in 2011 and 6.9 percent in 2012.

| ?

|

The report on Thursday came as data showed China's trade surplus narrowed in September as exports slowed sharply, with the world's second-largest economy hit by economic turmoil in the United States and Europe.

The IMF slightly lowered its growth forecast for China to 9.5 percent in 2011 from April's forecast of 9.6 percent and 9.0 percent in 2012 from 9.5.

The IMF report also highlighted the threat of capital outflows from the region, saying foreign investors from advanced economies could reverse the large positions they have built in Asian markets since 2009.

Severe spillovers

"The sell-off in Asian financial markets in August and September 2011 underscores that an escalation of euro-area financial turbulence and a renewed slowdown in the United States could have severe macroeconomic and financial spillovers to Asia," the report said.

Singh said though that, over time, capital was likely to flow back to Asia, attracted by the region's high economic growth.

One way the financial and economic woes of rich nations could have a knock-on effect on Asia was if European and US banks cut credit lines in Asia when faced with large losses at home, the IMF said.

Heightened economic risks amid persistent overheating pressures confront Asian policymakers with "a delicate balancing act", the report said. "They need to guard against risks to growth but also limit the adverse impact of prolonged easy financial conditions on inflation."

Many of the region's countries needed to continue normalizing easy macroeconomic policies to address inflation risks, both through higher interest rates and more flexible exchange rates, the IMF said.

"However, in economies where inflation is within central banks' target ranges and the exposure to severe external shocks is greater, a pause in monetary tightening may be warranted until the global uncertainties have lessened," the report added.

The IMF last month cut 2012 growth expectations for developing Asian economies and Japan, citing slower growth in the rest of the world. It also slashed its global growth projections.

Demand still strong

For now, the IMF maintained that domestic demand in the region remains strong and is expected to cushion the effect of weaker external demand on overall growth in the near term.

Japan could suffer if a rise in global risk aversion spills over to concerns about sustainability of its sovereign debt and leads to tighter financial conditions, it also said.

But in contrast to Japanese policymakers and executives raising alarm over yen levels close to record highs, Singh said the currency's present level did not pose an immediate risk to Japan's economic recovery. He also said recent data reinforced the view that recovery from the devastating March earthquake and tsunami was taking hold.

In general, Asian economies still have the scope to use a range of measures to cushion the effects of overseas shocks on economic activity, as many did in response to the 2008 global financial crisis, the IMF said.

"At the same time, the weakness in global demand only confirms that Asia would greatly benefit from further progress in rebalancing growth by developing domestic sources of demand," it said, adding that structural reforms, infrastructure investment and social spending would be needed for such rebalancing.

Should extreme economic risks materialize, Asian policymakers could stop withdrawing fiscal stimulus and central banks could draw on their large foreign exchange reserves and regional reserve pooling arrangements, the Washington-based international lender said.

Reuters - AFP