Google to buy Motorola Mobility for $12.5b

Updated: 2011-08-16 06:53

(Agencies)

|

|||||||||||

|

|

|

A posed picture shows a Motorola Droid phone displaying the Google search page in New York August 15, 2011. Google Inc will buy phone hardware maker Motorola Mobility Holdings Inc for $12.5 billion to bolster adoption of its Android mobile software and compete with smartphone rival Apple Inc. In its biggest deal to date, Google said it would pay $40 per share in cash, a 63 percent premium to Motorola Mobility's Friday closing price on the New York Stock Exchange. [Photo/Agencies] |

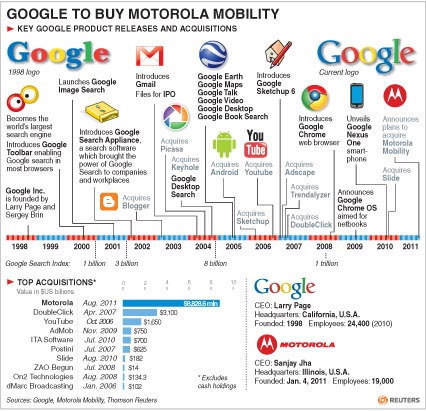

NEW YORK/SAN FRANCISCO - Google Inc is paying $12.5 billion to buy Motorola Mobility Holdings Inc in its biggest-ever deal, finally securing a swathe of valuable mobile patents to ramp up a war with Apple Inc and other rivals.

The acquisition of the company that invented the cellphone - co-founder and CEO Larry Page's boldest move since taking the reins in April - will transform the mobile landscape and gives Google one of the industry's largest patent libraries.

Analysts say the Internet search leader may be paying through the nose for the patents after losing out to Apple, Microsoft Corp and others for bankrupt Nortel's assets, but that it had few other options as its competitors increasingly sue over intellectual property.

Wall Street quickly anointed Microsoft a winner in this deal, with Windows potentially benefiting if the acquisition alienates the 38 other phone makers that rely on Google's Android. The deal stoked immediate speculation that Nokia and Research in Motion - struggling device makers in a mobile arena dominated by Apple - would become takeover targets themselves, sending Nokia's shares up more than 17 percent and RIM's up more than 9 percent.

"Google decided to cross the Rubicon on the device side," said Fred Huet, head of telecoms and media consultancy Greenwich Consulting. "There has been growing frustration (at Google) about the lack and speed of Internet centric devices.

"With Nexus they tried to show the industry what they thought was the right evolution for handsets and it did not have an impact .... With the patents they make sure that Android stays strong."

Google is building up its patent portfolio - seen as one of the weakest in the industry - after it lost out to its rivals on Nortel.

"Motorola has a strong patent portfolio which will help protect Android from anti-competitive threats from Microsoft, Apple and other companies," Page told analysts on a call.

THE MORE THINGS CHANGE ...

The deal - which took Wall Street by surprise - appears to mark a shift in strategy from Google's traditional Internet search and advertising empire and occasional forays into video and social networking. But the reality is that it is not a major change. Within its mobile operations, the deal simply moves Google to the Apple business model from that of Microsoft.

"The danger is that other handset makers feel disenfranchised," said Nomura Securities global technology specialist Richard Windsor. "Motorola is the weaker player. This could actually collapse the entire community."

Page, who also launched the ambitious Google+ to compete with Facebook since taking over as CEO, reassured investors on Monday this would not happen, saying that Motorola Mobility will be run as a separate company licensing Android software in the same way as rivals like HTC Corp and LG Electronics.

Phone makers including Samsung Electronics officially said they welcomed a deal that will aid their own legal battles, but some analysts questioned the sincerity of those claims, noting that rival companies would now be unlikely to heavily promote Android since it would benefit a direct competitor.

While analysts see the deal primarily as a way for Google to protect and build out its mobile business, they doubt that it would continue manufacturing handsets in the long term.

"We don't think they necessarily want to be in the business. They want those patents first and foremost," said UBS analyst Brian Pitz. "This is really a game of protection."

While Apple's iPhone leads in market prestige and is seen as more innovative, Android has quietly surpassed it in market share. Android held a 43.4 percent share of the smartphone market at the end of the second quarter, ahead of Nokia's 22 percent, according to Gartner data. Apple ranked third with 18 percent, the data showed.

The deal values Motorola Mobility at $40 per share in cash, a 63 percent premium to its Friday closing price. The terms of the deal also features an unusually rich reverse breakup fee of $2.5 billion, according to a source close to the situation.

"It's a deal that will take time to pay off, but they have a lot of cash and they want to chase after profit," BGC Partners analyst Colin Gillis said.

Shares of Motorola Mobility jumped more than 55 percent on the news, while Google fell about 1 percent on Nasdaq.

The deal delivers a windfall for investors including Carl Icahn, Motorola's top shareholder with a stake of just over 11 percent. The activist shareholder had been urging Motorola to look into splitting off its patent business - one of the biggest in the industry - from its handset business, ranked eighth in the world by Gartner in terms of unit sales.

|

|

INTO THE LIVING ROOM

As part of the deal, Google also gets Motorola's set-top box businesses, giving its nascent TV operation a much-needed boost by providing it with a more direct route into the home.

Bernstein analyst Craig Moffett noted that Google, a frequent disrupter of the pay-television market via its ownership of YouTube and launching of over-the-top TV products that allow consumers to get streaming video in the home, will now be one of its largest suppliers.

"It will be fascinating to see whether this tempers their enthusiasm for disruptive business models as they have to face the practical realities of satisfying their cable customers," said Moffett. "I think the cable industry would be delighted to see Google inside the tent."

Google said it expects the deal to close by the end of 2011 or early in 2012, and that it was confident it would gain the regulatory approvals required in the United States and Europe and the blessing of Motorola Mobility's shareholders.

ANTITRUST REVIEW

Legal experts said the deal was likely to draw even closer scrutiny than usual from antitrust regulators given its size and the fact that they have already launched a formal investigation into Google's business practices. Among the charges leveled at Google is that is manipulates its search engine results to favor its own properties.

"Overall, I don't see any obstacles in terms of regulatory hurdles, but at the same time I wouldn't expect this to be an easy road for Google," said Hendi Sutano, an analyst at Gabelli & Co. "I think that the expectation that the deal will be closed by the end of the year or early 2012 is realistic. Motorola Mobility is outside of Google's core expertise and has a small market share overall.

Lazard advised Google on the deal, while Motorola used Centerview Partners and Frank Quattrone's Qatalyst Partners, sources told Reuters.

Related Stories

Bing aims to slay the Google giant 2011-08-14 07:47

Google cries foul on Apple, Microsoft mobile gang-up 2011-08-04 08:37

Google to launch 'Harry Potter' ebooks 2011-07-21 08:52

Regulator provides directions for Google and Microsoft 2011-07-09 07:59

Hot Topics

The European Central Bank (ECB) held a conference call late on Sunday ahead of the market opening, pledging the ECB will step in to buy eurozone bonds with efforts to forestall the euro zone's debt crisis from spreading.

Editor's Picks

|

|

|

|

|

|