Chinese shares 'too cheap to ignore': HSBC

|

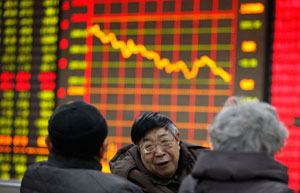

Investors discuss market trends at a securities house in Fuyang,Anhui?province. So far this year,48 Chinese companies have listed on the A-share market, raising 22.4 billion yuan. Lu Qijian / for China Daily |

BEIJING -- Chinese shares have fallen to levels which are well below their five-year average, and are "too?cheap to ignore", HSBC said in its latest China investment atlas.

"No matter whether it is in terms of price-to-earnings or price-to-book terms, some Chinese stocks are valued even lower than during the global financial crisis," said HSBC's Head of China Equity Strategy Steven Sun in the report.

In the past few weeks, China has been producing a series of tepid macro economic data, and has had no shortage of bad news. The onshore bond market may soon witness its first bond default in recent history, while the Chinese currency Renminbi has fallen to the lowest level in a year.

The HSBC/Markit manufacturing purchasing managers' index (PMI), which sampled small- and medium-sized enterprises, dipped to an eight-month low of 48 in March, from a final reading of 48.5 in February. It also signaled the sharpest fall of output since November 2011.

Although the timing of a stock market bottom is difficult to call, downside risks have been alleviated by the depressed valuation, Sun said.

Against the rest of the region, China also offers clear value. In terms of price-to-earnings multiples, the discount that Chinese equities trade at is the widest it has been since 2007, he said.

The market hopes that policy makers in China take fresh steps to boost the country's flagging economy.

"We think a rally might be underway due to the cheap valuations, but this is more likely to be a short-term rebound than a new cyclical bull market," Sun said. "We maintain our cautious stance on 2014 stock market performance, given the structural challenges that China needs to overcome."

Sun said most of HSBC's 2014 index target forecasts are unchanged, with Morgan Stanley Capital International (MSCI) China at 68 and Hang Seng Index at 24,000.

But HSBC slightly lowers Shanghai Composite Index to 2,400 from 2,500 and the Hushen 300 Index of the leading Shanghai and Shenzhen A-share listings to 2,600 from 2,800.

These targets imply potential returns of 11 percent to 24 percent by the end of next year, including dividend yield. Potential return equals the percentage difference between the current index level and target level, including forecast dividend yields when indicated, Sun said.

On Tuesday, the benchmark Shanghai Composite Index opened lower at 2,054.53 points, down 0.21 percent. The Hushen 300 Index opened at 2,179.92 points, down 0.25 percent.

|

|

| China's CSI300 index in biggest loss in 7 months |

熱門推薦

更多> 李肇星法國憑吊884名一戰(zhàn)華工墓地

李肇星法國憑吊884名一戰(zhàn)華工墓地  待你胡子及腰 借我插花可好?

待你胡子及腰 借我插花可好?  直擊西班牙奔牛節(jié)活動(dòng):牛角刺穿參與者大腿

直擊西班牙奔牛節(jié)活動(dòng):牛角刺穿參與者大腿

俄羅斯海灘酷暑天突降冰雹

俄羅斯海灘酷暑天突降冰雹  數(shù)千巴勒斯坦人緊急逃離加沙

數(shù)千巴勒斯坦人緊急逃離加沙  友誼第一 德國球員安慰阿根廷隊(duì)梅西

友誼第一 德國球員安慰阿根廷隊(duì)梅西 世界杯閉幕式盛大舉行

世界杯閉幕式盛大舉行  韓市民在日本駐韓大使公邸前示威抗議

韓市民在日本駐韓大使公邸前示威抗議  首屆歐洲健身氣功運(yùn)動(dòng)會(huì)在比利時(shí)蒙斯舉行

首屆歐洲健身氣功運(yùn)動(dòng)會(huì)在比利時(shí)蒙斯舉行

巴基斯坦女性救援隊(duì)員參加檢閱 英姿颯爽

巴基斯坦女性救援隊(duì)員參加檢閱 英姿颯爽  中國日報(bào)漫畫:玩命

中國日報(bào)漫畫:玩命  以軍加強(qiáng)對加沙地帶空襲 三歲男童一家四口身亡

以軍加強(qiáng)對加沙地帶空襲 三歲男童一家四口身亡 土耳其“巨人”少女獲吉尼斯世界紀(jì)錄

土耳其“巨人”少女獲吉尼斯世界紀(jì)錄  埃及開放拉法邊境 埃及裔巴勒斯坦民眾翻墻離境

埃及開放拉法邊境 埃及裔巴勒斯坦民眾翻墻離境  金正恩檢驗(yàn)部隊(duì) 指導(dǎo)火箭試射(圖)

金正恩檢驗(yàn)部隊(duì) 指導(dǎo)火箭試射(圖)

瑞典攝影師惡搞歷史名人 將女兒PS成拿破侖萌翻眾人

瑞典攝影師惡搞歷史名人 將女兒PS成拿破侖萌翻眾人  中國日報(bào)漫畫:渾然不覺

中國日報(bào)漫畫:渾然不覺  攝影師潛水遇珍稀海龜 自拍與其親密接觸瞬間

攝影師潛水遇珍稀海龜 自拍與其親密接觸瞬間

實(shí)拍4.5米長鱷魚吞下小馬駒過程

實(shí)拍4.5米長鱷魚吞下小馬駒過程  阿薩德宣誓就任敘利亞總統(tǒng) 圖揭其神秘家庭生活

阿薩德宣誓就任敘利亞總統(tǒng) 圖揭其神秘家庭生活

- 泰肅貪委決定以玩忽職守罪名起訴英拉

- 澳總理望今年簽澳中自貿(mào)協(xié)定

- 以官員稱與加沙達(dá)成全面停火協(xié)議

- 烏克蘭稱俄戰(zhàn)機(jī)擊落一架烏飛機(jī)

- 韓國有望超泰國成中國出境游最大目的地

實(shí)拍4.5米長鱷魚吞下小馬駒過程

實(shí)拍4.5米長鱷魚吞下小馬駒過程  阿薩德宣誓就任敘利亞總統(tǒng) 圖揭其神秘家庭生活

阿薩德宣誓就任敘利亞總統(tǒng) 圖揭其神秘家庭生活

- 李肇星法國憑吊884名一戰(zhàn)華工墓地

- 待你胡子及腰 借我插花可好?

- 直擊西班牙奔牛節(jié)活動(dòng):牛角刺穿參與者大腿

- 俄羅斯海灘酷暑天突降冰雹

- 數(shù)千巴勒斯坦人緊急逃離加沙

美元壟斷的時(shí)代結(jié)束了?

美元壟斷的時(shí)代結(jié)束了?  “股神”巴菲特是怎么玩慈善的?

“股神”巴菲特是怎么玩慈善的?

- 尼加拉瓜運(yùn)河選線獲批 年底動(dòng)工

- 英媒:金磚峰會(huì)確認(rèn)中國核心

- 中國房企在海外怎么玩?

- 日媒:中企靠買歐洲品牌擴(kuò)大知名度

- 中國、巴西、秘魯將共建兩洋鐵路

TVB貌美如花的演技派女星卻只能打醬油

TVB貌美如花的演技派女星卻只能打醬油  純粹瞿穎最美新四十 光影年華如書側(cè)聽世間風(fēng)雨

純粹瞿穎最美新四十 光影年華如書側(cè)聽世間風(fēng)雨

- 張馨予拍夢幻寫真 化身花仙子?jì)趁膭?dòng)人

- 好聲音導(dǎo)師陣容首秀 汪峰嘴甜那英腹黑

- 朱莉每月找整容醫(yī)生 接受治療保持青春

- 劉濤清涼寫真登封面 溫柔恬靜似天使

- 香港51歲男星張耀揚(yáng)在北京吸毒被拘

新聞熱搜榜

來源:360新聞精彩熱圖

24小時(shí)新聞排行

獨(dú)家策劃

精彩推薦

- [電影] 《霍比特人3》首曝劇情 五軍上演史詩生死大戰(zhàn)

- [譯名] 臺媒稱《變形金剛》內(nèi)地譯名俗氣內(nèi)地反擊 擎天柱、無敵鐵牛到底哪個(gè)更俗氣?

- [電影] 《霍比特人3》將曝先行預(yù)告 正式版10月發(fā)布

- [影節(jié)] 71屆威尼斯電影節(jié)海報(bào)出爐 靈感來自《四百擊》

- [票房] 250個(gè)小時(shí)超《阿凡達(dá)》票房紀(jì)錄 《變4》迎悲喜兩重天

- [電影] 《變4》中國票房大勝 北美市場口碑失利

- [熱點(diǎn)] "蜘蛛俠"導(dǎo)演換口味 有望挺進(jìn)阿富汗戰(zhàn)場

- [預(yù)測] 《星際迷航3》將拍 角色更貼近原初劇集