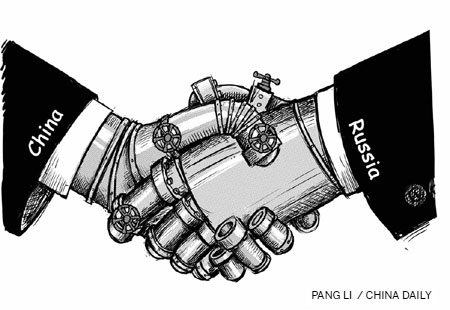

Dmitri Medvedev's first visit to China as Russia's prime minister will further cement Beijing-Moscow energy relationship. This alliance rests on a simple formula: substantial Chinese credits for long-term Russian energy supplies. Thus, cash-rich China buys a measure of energy security, and Russia gets much-needed cash for its budget. In the current geopolitical setting, however, this essentially pragmatic relationship acquires features of an energy alliance.

Since 2009, China has been Russia's biggest trading partner. The two-way trade, which stood at $88 billion last year, is finely balanced between exports and imports. There is a huge imbalance, however, as far as the trade structure is concerned. About 90 percent of Russian exports are hydrocarbons; machinery accounts for less than 1 percent. Despite the Russian government's professed desire to diversify the country's exports, the energy element has only grown in the past few years. Russia has become one of China's energy bases.

Russia's advantage as an energy source, in Chinese eyes, is that its supplies cross into China over land, and directly. Unlike sea routes, they are essentially protected from third-country interference. Pipelines also tie Russia to the Chinese market, and give Beijing leverage in case of a dispute.

The fact that China has other similar continental sources besides Russia, such as Myanmar and Central Asia, further increases Beijing's power. China these days is very much a buyers' market.

Russian-Chinese energy deals are complex. Beijing places a big order with Moscow and expects to get a discount. This has worked for oil, with Rosneft concluding a series of agreements with China National Petroleum Corporation, and now also with China Petroleum and Chemical Corporation (or Sinopec) - in an attempt at in-country diversification of partners. It has not yet worked for gas. And although a final agreement on the gas price is expected before the end of this year, it has been "imminent" since mid-2011.

Also, China has been able to engage Russia's largest private gas producer, Novatek, in a long-term deal. The deal, concluded last June, marks a new milestone. Russia, until recently reluctant to allow China's State-owned companies direct access to its energy resources, has softened its stance. Thanks to the Novatek deal, CNPC will now have a direct stake in a gas field on the Yamal Peninsula.

The deal struck in Beijing with Rosneft promises even more: joint exploration and exploitation of oil and gas reserves in eastern Siberia. Such agreements effectively turn the Chinese-Russian energy trade into an energy alliance.