-

-

China Daily E-paper

From Chinese Press

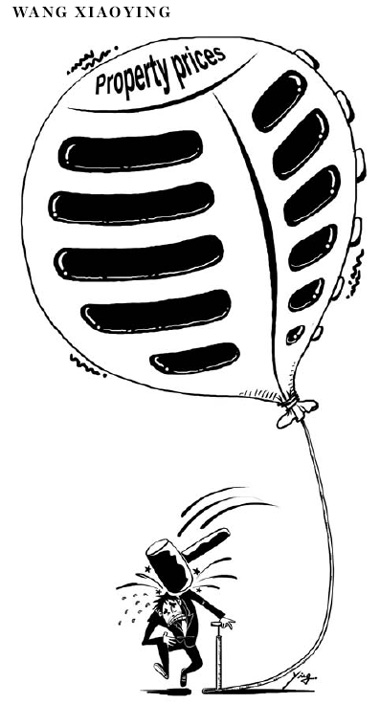

China must end property bubble

( Agencies)

Updated: 2010-04-23 10:01

|

Large Medium Small |

China must tackle its property bubble for the sake of economic health and social stability, even if the market feels some short-term pain in the process, an official financial newspaper said on Thursday.

Monetary tightening, along with steps to control housing demand and expand supply, are the right policy choices for the government, the China Securities Journal said.

The front-page commentary adds to the impression that officials are determined to make a success of their latest crackdown on property speculation. Previous attempts to cool prices have been tempered by a fear of over-tightening because the property sector is a pillar of the economy.

Tough new measures announced in the past week have wiped out 240 billion yuan ($35 billion) in the market value of listed developers and the damage will spread to related industries, the newspaper said.

But this is a necessary price to pay to head off an "all-citizen house-buying boom," the commentary said. Left unchecked, it would distort the economy by suppressing much-needed consumption as people put so much of their savings into property.

"Industry insiders now believe that the key factor in determining our country's stable growth is whether or not there can be a soft landing for the property market," it said.

"Clearly, given that monetary expansion caused the housing bubble, we first need to address it through monetary contraction."

The government has repeatedly warned of the dangers of China's red-hot property market, which it has described as one of the country's most pressing economic problems, and has tried to get banks to rein in property lending.

Urban property inflation rose to 11.7 percent in the year to March from February's 10.7 percent pace. Economists believe the official figures seriously understate the extent of price rises, especially in major cities.

China's cabinet on Saturday laid out further detailed measures aimed at keeping the property sector in check, empowering and ordering local governments to take steps to control speculative buying.

The head of China's banking regulator warned banks again on Tuesday against extending loans for speculative property investments and ordered big lenders to conduct stress tests of real estate loans on a quarterly basis.