Debate: Luxury goods

Should the tax on luxury products be reduced? Three experts were asked about their views, and they came up with three different answers. Read on ...

Liu Shangxi

Do not cut tax on luxury goods

Many people are debating whether the government should reduce the tax on luxury products. The answer is "no", because luxury goods are not necessities. Since consumers of luxury products are generally rich, high taxes will make them part with some of their money, no matter how small that fraction is, and help narrow the wealth gap in the country.

The consumption of luxury goods is already high in China. According to the latest report of the World Luxury Association, China's luxury goods market was worth $10.7 billion in 2010, or one-fourth of the world's total. Moreover, China is likely to surpass Japan as the largest luxury goods-consuming country in 2012.

Many luxury brands have intensified their marketing campaigns in China, opening new outlets and even expanding their sales networks in second- and third-tier cities. Compared to China's national GDP, which is less than 10 percent of the total global GDP, its 25 percent share in the global luxury market is irrational.

Even without any tax cut, the sales of luxury goods are expected to increase in China. A reduction in tax on luxury goods will only prompt the existing consumers to buy more and/or attract new ones into the market, increasing the already high consumption further. Though many feel a cut in tax will reduce the sales of luxury products, the notion is contrary to the reality in China.

There are different definitions of luxury goods. But the most significant characteristic of a luxury product is its high price, which consumers tend to think adds to their social status. In other words, consumers draw satisfaction from the price and show-off factor of expensive products. By nature, luxury products are targeted at a small section of society. That's why only the high-income groups rush to buy them.

Many Chinese travelers have started buying such products overseas. The government levies taxes on all luxury goods irrespective of whether they are made in China or foreign countries, which reflects the country's unified and fair taxation system. Taxes are levied on imported luxury goods during the import process and on domestic ones at the production and retail stages.

According to taxation and Customs laws, Chinese tourists who buy goods worth more than 5,000 yuan ($773) overseas have to declare them and pay value-added and consumption taxes on re-entering the country, which brings the prices of luxury products in overseas and domestic markets on par. But since many travelers do not declare them to Customs, they end up paying less than the actual price.

Besides, there is no reason to assume that a reduction in tax on luxury products will boost overall domestic consumption, because most of them are made by overseas companies and, by definition, are imported goods. On the contrary, if we encourage the consumption of such goods, it will harm the competitiveness of domestic enterprises, leading to serious consequences for the Chinese economy.

Although many luxury products are made in China, the domestic enterprises making or assembling them receive a tiny amount as "processing" fee, which is just a fraction of the profit that the brand-owning company makes.

Take the iPhone for example, which costs $499. The company in China that actually makes them, or the original equipment manufacturer, gets only a few dollars for every product.

Therefore, the government cannot expect to boost the domestic market by encouraging the sale of luxury products in China to increase.

The author is vice-director of the Research Institute for Fiscal Science, affiliated to the Ministry of Finance. The article first appeared in the People's Daily.

Zhao Ping

Enough reason to reduce import duties

The existing import duty system has not kept pace with the changing consumption pattern of the Chinese people. Thanks to the country's rapid economic growth some medium- and even high-end goods are no longer luxuries; they have become almost necessities for some people. Today, many people from the middle-income group can afford products that not so long ago were considered luxuries.

It is thus important that the government see them as almost necessities or better quality consumer goods. Rather than imposing high import duty on them, the government should strike some of them off the duty list.

A reduction in the tax of some brands that a part of the middle class can afford would encourage more enterprises to import them, and help boost domestic sales. It is abnormal to see some products, which actually are common popular consumer goods overseas, treated as luxury products in China because of the high tax imposed on them.

For example, even though imported cosmetics are defined as luxury products, many people in China buy them and end up paying too high a price. The total tax on imported cosmetics is 57 percent - 30 percent consumption tax, 17 percent value-added tax and 10 percent tariff - which is very high according to international standards.

Besides, a reduction in tax would also attract companies that own some of the so-called luxury brands to open factories in China, which will expand domestic demand and create more jobs. The subsequent increase in their sales would offset the loss in government revenue. And if more foreign brands set up factories in the country, Chinese enterprises can learn from them product design, management and sales techniques, which will lead to a healthy and fair competition among domestic brands.

If the authorities continue with their high import tax policy, it will force some domestic consumers to buy the so-called luxury goods during their trips abroad or in duty free shops at airports.

The marketing and sale of some well-known brands face many problems in China. There are many tiers in the sales chain of a large number of medium- and high-end imported products. Usually, regional agents do not have strong bargaining powers, which allows their overseas manufacturers to keep their prices high to make maximum profit. Some hidden rules such as "slotting allowance" and "feedback", too, push up the prices of these so-called luxury goods.

The government should standardize the business of such goods by promoting a new marketing pattern, including chain stores or factory shops, to reduce the tiers in the sales chain and make them more affordable for consumers.

Some experts oppose any tax reduction on luxury products because they think domestic demand can be boosted only by increasing the sales of domestic goods. What they fail to see, however, is that such a move could harm the competitiveness of domestic corporations and the Chinese economy.

Most of the medium- and high-grade product makers follow the business model of "small profits and quick returns", few of them aim to make high profits through limited sales. So it makes sense to lower the tax on medium- and high-grade goods.

According to economics, every imported product has a "spill effect". Many luxury brands do have their production units in China, but their products are at the bottom end of the "smile curve". What we need, instead, are brands higher up in the curve.

The author is a research scholar with the Chinese Academy of International Trade and Economic Cooperation, affiliated to the Ministry of Commerce. The article first appeared in the People's Daily.

Deng Jinglong

We should aim at balanced development

In these times of rising commodity and housing prices, the public will react sharply to any news of further price rise and welcome news to the contrary. But the news of a possible reduction in the tax on luxury products has to be analyzed properly, even though it is aimed at making consumers who tend to go on a shopping spree during their travels abroad turn to the domestic market.

Surprisingly, two national departments are locked in a battle. The Ministry of Commerce has announced that a common agreement was reached on the issue, but the Ministry of Finance has responded by saying it was not aware of it.

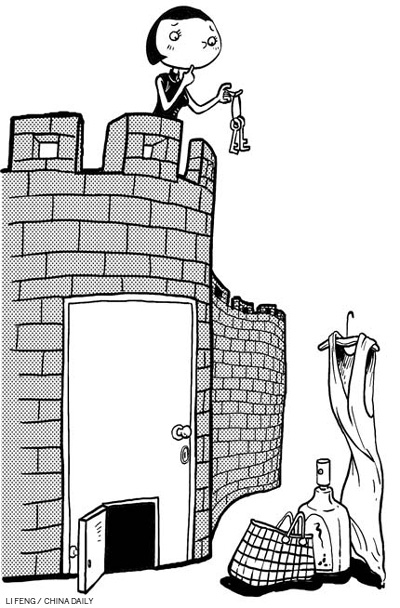

China has become the second largest luxury goods consuming country, but many people buy these luxury products overseas to avoid the high import duty on such goods imposed by the Chinese government.

Some netizens oppose the tax cut on luxury goods. They say an important role of a tax is to "take from the rich to give to the poor". So the high tax on luxury products should be justified, because they are bought by rich people. The argument seems correct. But there is a problem. Nowadays, not only the rich, but also some middle-income group people buy many of the so-called luxury products.

The fast pace of economic development over the past three decades has brought about a significant change in Chinese people's consumption habits. Some consumers treat many a luxury product just as a simply high-priced commodity. Cosmetics and perfumes, which cost a few hundred yuan, and some moderately expensive watches, worth a few thousand yuan, are some of the so-called luxury products that many middle-income people can afford today.

But if any of these products is available at half or 60 percent of the price in a foreign country, any Chinese traveling overseas would prefer to buy it there. No wonder, a major part of the agenda of many Chinese people traveling abroad is shopping for some so-called luxury goods.

Looking at the issue from such people's point of view, the tax on some imported luxury goods should indeed be reduced. For example, the tax on so-called luxury products that have become popular among Chinese consumers, such as clothes, perfumes, cosmetics, watches and bags, should be reduced. This will help keep a large amount of the money that Chinese travelers spend abroad in the domestic market and create more jobs in the country.

To maintain stability in the domestic market, however, tax on all luxury products should not be reduced. The tax on high-end luxury goods like branded bags that cost thousands of yuan, and sports and custom-made cars that can cost millions of yuan should not be reduced. In fact, the government should increase the tax on such products. After all, such luxury products are bought only by the rich, who are not so sensitive to price rise.

In short, the key to ending the dispute over tax on luxury goods is to classify luxury goods in the light of the changing times. Tax should be levied on a product according to its classification.

To begin with, tax on some popular consumer goods should be reduced and that on real luxury products, which are consumed by only the rich, should be increased.

The article first appeared in the tianjinwe.com.

(China Daily 07/11/2011 page9)