Investors demand higher interest rates following yuan devaluation

Updated: 2015-08-18 07:58

By Bloomberg in Hong Kong(HK Edition)

|

|||||||||

Hong Kong investors spooked by the mainland's surprising renminbi devaluation are demanding higher interest rates to hold the currency. BlackRock Inc is among those sniffing a buying opportunity.

The average yield on offshore renminbi notes rose 42 basis points last week to 4.78 percent, the highest since May, according to a Deutsche Bank AG index. Three-month interbank rates for the currency in Hong Kong spiked 64 basis points, prompting banks including Standard Chartered Plc and DBS Group Holdings Ltd to raise deposit rates.

"Once currency volatility normalizes, the market should revert to yield-seeking behavior," Suanjin Tan, a fund manager at BlackRock, wrote in a report on Friday. "While we are mindful that some investors in the offshore renminbi bond space might have been spooked by the volatility, we are confident that if investors stay the course, they will be rewarded."

Strategists at CITIC Securities Co and Standard Chartered recommended buying dim sum bonds, while Taiwan's Cathay Securities Investment Trust Co said it would add to holdings once calm returns. A measure of swings for the currency in the coming month fell from a record in the final two days of last week as the central bank said it would act to curb excessive moves and predicted long-term appreciation.

The renminbi was little changed at 6.3942 a US dollar as of 10:54 am in Shanghai on Monday as the People's Bank of China (PBOC) kept the fixing steady, another sign the currency's rout had ended.

The mainland startled global markets on Aug 11 when it weakened the renminbi's daily reference rate by a record, sparking the biggest sell-off since 1994. The PBOC said this was a one-time adjustment, and part of a broader plan to make the fixing more aligned with market forces. It moved to calm investors after a 2.8 percent drop in two days, saying there was no reason for further depreciation. Major mainland lenders were seen selling US dollars toward the end of trading on three straight days, spurring speculation the worst is over.

The surprise prompted a surge in interbank renminbi rates in Hong Kong, leading Standard Chartered to raise the interest on new six-month renminbi savings to 3 percent from 2.4 percent. China Construction Bank (Asia) Corp lifted its deposit rate twice to 3.1 percent from 2.3 percent before the devaluation.

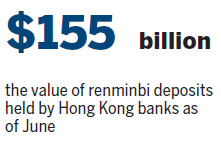

Hong Kong banks held 993 billion yuan ($155 billion) of deposits as of June, the biggest offshore stockpile. As about 80 percent of the city's renminbi savings are time deposits, which penalize customers for withdrawing early, outflows may be limited, according to Frances Cheung, head of Asia ex-Japan rates strategy at Societe Generale SA in Hong Kong.

This has stopped some investors from liquidating their renminbi deposits, said Stella Lee, president of Success Wealth Management Ltd in Hong Kong. While she said on Aug 12 that she was planning a trip to Shenzhen, the mainland city that borders Hong Kong, to withdraw renminbi from a bank, some of her friends have their money locked in time accounts.

(HK Edition 08/18/2015 page8)