BYD Q4 net plunges 94% to 90m yuan

Updated: 2011-03-15 07:06

By Emma An(HK Edition)

|

|||||||||

|

Wang Chuanfu, BYD chairman, speaks during a news briefing for the company's annual results in Hong Kong Monday. He said it will be difficult for the car market to maintain growth levels seen in 2010. Dale De La Rey / Bloomberg |

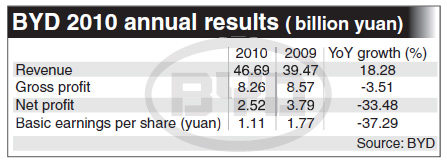

Firm reports FY 2010 income down 33.5% to 2.52b yuan

Warren Buffett-backed automaker BYD Co Ltd said Monday that its fourth-quarter net profit to December 31 dropped a worse-than-expected 94 percent to 90 million yuan on falling demand and added that it expects car sales to slow down nationwide in 2011.

BYD also reported that its net profit for 2010 shrank by 33.48 percent to 2.52 billion yuan on slowing car sales growth despite an 18.28 percent rise in its full-year revenue. The stock fell 1 percent to HK$34.6 per share in city trading on Monday.

The fourth-quarter net income figure was calculated by subtracting nine-month earnings from Monday's full-year results announced by the company. That compares with the 830 million yuan average of 11 analyst estimates compiled by Bloomberg and based on their 12-month projections.

The company posted revenue of 46.69 billion yuan in 2010, of which 46 percent came from auto sales, down from 53 percent a year earlier. Sales of cell phone components soared 42.77 percent compared with 2009 and accounted for 44 percent of its 2010 revenue, up from 37 percent previously.

Its rechargeable batteries business made up another 10 percent of the revenue, unchanged from 2009. No final dividend will be paid in 2010, according to BYD, compared with a final dividend of 0.33 yuan per share for 2009.

"It will be difficult for the (car) market to maintain the growth seen in the past year," Chairman Wang Chuanfu told a media conference on Monday, citing unfavorable factors including the scrapping of tax incentives for smaller cars as well as the imposition of restrictive policies on car ownership to ease traffic congestion.

The domestic car market may see 10-15 percent growth this year, said Wang, a growth rate BYD's car sales would be in line with. Auto sales in China surged by 32 percent to a record 18.06 billion in 2010, partly helped by the government subsidies on car purchases.

Notwithstanding the record growth that has helped the country remain the world's largest car market for a second consecutive year, BYD saw its car sales growth dip to a meager 10 percent in 2010 compared with a whopping 162 percent in 2009. The company sold 519,806 units last year, 13 percent short of its 600,000 target, which had already been revised down in August from 800,000.

Slipping sales and rising competition prompted BYD's first ever official price cut in February this year when the company slashed the prices on its five-best selling models by up to one-fifth. The move came after the company said its car sales dropped 15 percent in January and 22 percent in February from a year ago.

For 2011, Wang said the company's major task is to boost the production capacity for battery-powered cars while shifting its focus from expanding the auto distribution network to optimizing it instead, which will see BYD pare down the number of its auto distributors to below 1,000.

Meanwhile, the company will flesh out its product lines and increase market share with the launch of new models S6, G6 and a minivan.

How well the company will fare in 2011 remains to be seen, but "10-15 percent (car) sales growth is likely for BYD", said Linus Yip, a strategist at First Shanghai Securities. He told China Daily that he still expects the company to "take the lead in electric car manufacturing".

Electric car manufacturing has been made increasingly attractive due to central government support for fuel-efficient car production and subsidies of as much as 60,000 yuan for electric car buyers in a bid to boost demand.

General Motors Co has talked about bringing its electric cars to China this year, as has Nissan Motor Co. Meanwhile, Volkswagen AG - Europe's largest carmaker - is looking to sell 10,000 electric cars in China from 2014 to 2018.

Bloomberg contributed to this story.

China Daily

(HK Edition 03/15/2011 page3)