|

Bank of China targets Hong Kong IPO in May

(AFP)

Updated: 2006-02-08 13:53

Bank of China, the country's third largest bank, plans to list in Hong Kong

in May and later wants to raise more cash by selling shares on domestic markets.

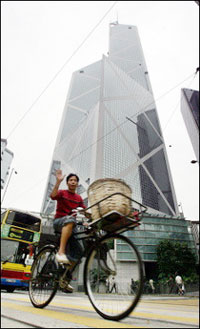

Bank of China

headquarters in Hong Kong, where the country's third largest bank plans to

list in May and later wants to raise more cash by selling shares on

domestic markets. [AFP] | The lender, one of

China's four major state-owned banks, has filed its dual-listing plan with the

State Council or cabinet and expects the initial public offering of Hong Kong in

May, the China Securities Journal reported.

After the issue of H-shares in Hong Kong, Bank of China will then issue

A-shares on the Shanghai Stock Exchange as soon as possible, the report said,

citing an unnamed source familiar with the matter.

The Hong Kong-based South China Morning Post reported Wednesday that the

authorities may decide what portion of Bank of China's existing shares will be

listed as H-shares this week.

The State Council last month gave in-principle approval to Bank of China's

plan to sell up to 15 percent of its enlarged share capital in the Hong Kong

IPO.

Bank of China has finished pre-listing preparation and can float shares

within 15 months of government approval, although much rides on market

conditions, especially with its domestic portion of the listing, the newspaper

said.

The flotation would follow the successful Hong Kong listings of Bank of

Communications and China Construction Bank last year, the first privatisations

in China's huge and heavily protected banking sector.

China believes privatisation will bring the country's massive and often

ill-governed financial institutions into order before the industry is opened up

to international competition at the end of the year.

However, only recently two former managers for the state-controlled Bank of

China were charged in the United States with stealing more than 485 million

dollars and laundering money through Las Vegas casinos.

China's banking regulator admitted Monday that corruption continues to plague

the sector with some 95 billion dollars in the nation's banking system

identified in 2005 as irregular, 31 percent higher than the previous year.

Scrambling to reassure investors, the Bank of China said this week it would

cooperate with US authorities and was cracking down internally to safeguard bank

assets.

The Beijing-based group has Royal Bank of Scotland, Switzerland's UBS and the

Asian Development Bank as strategic investors, which, according to regulators,

have invested 3.675 billion dollars.

The Singapore government's investment arm, Temasek, could also buy five

percent of Bank of China for 1.5 billion dollars, Chinese press reports have

said.

|