|

US pushing for more open markets in China

(chinadaily.com.cn)

Updated: 2005-10-16 09:12

The Bush administration's economic team is expected to argue for a quickening

pace of China's financial market reform, and push the country wide open to

foreign banks, investment firms and insurance giants.

U.S. Treasury Secretary John Snow and the Federal Reserve chairman Alan

Greenspan are leading a strong economic delegation visiting Beijing, who are

sitting face to face on the table with Chinese economic officials on Sunday in

the annual joint Sino-American economic conference.

U.S Treasury Department senior officials say the plan for the Chinese is part

of an comprehensive Washington bid to put the Chinese currency yuan into a

broader debate over China's reliance on exports as the main engine of economic

growth, the New York Times reported.

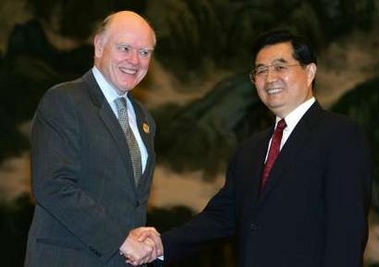

Chinese President Hu Jintao (R) shakes hands

with U.S. Treasury Secretary John Snow during a meeting with leaders of

the G20 Finance Minister and Central Bank Governors inside the Great Hall

of the People in Beijing October 15, 2005.

[Reuters] | The plan calls for Beijing to speed up

the privatization of state-owned companies, including banks; to develop a

Chicago-style futures market for currency trading; to establish an independent

credit-rating agency; and to crack down on bailouts for banks left holding bad

loans.

"What we tried to do is take a quantum leap in sophistication and scope,"

said Timothy D. Adams, undersecretary for international affairs at the Treasury

Department. "It gives you a picture of the truly complex nature of what we are

trying to do."

Bank of England Governor Mervyn King (C) chats

with U.S. Federal Reserve Board Chairman Alan Greenspan (R) after a

luncheon during the G-20 Finance Ministers and Central Bank Governors

meeting in Grand Epoch City in Xianghe of the Hebei province, about 100 km

(62 miles) east of Beijing October 15,

2005.[Reuters] | Though many of the ideas are not

fresh, and often supported by Chinese leaders in principle, the list reflects an

increased effort to lecture Chinese officials about its internal financial

issues, which could backfire, the New York Times reported.

|