Ping An profit increased 25 percent in 2010

Insurer says recent rights issue in HK will satisfy capital demand

SHANGHAI - Ping An Insurance (Group) Co, China's second-biggest insurer by market capitalization, said on Wednesday it will not raise capital on the financial markets in the short-term following a rights issue a few weeks ago.

"We have met all the capital requirements and our profitability keeps getting better, so I think the rights issue in Hong Kong will satisfy our capital demand over a period of time," said Ma Mingzhe, the chairman of Ping An, after announcing a 25 percent gain in profit in 2010 to 17.3 billion yuan ($2.64 billion), or 2.3 yuan a share.

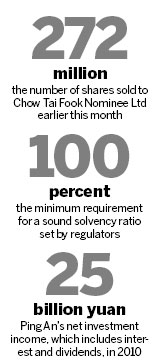

Earlier this month, the insurer, which is partly owned by HSBC Holdings Inc, sold 272 million shares at HK$71.50 ($9.18) each in Hong Kong to Chow Tai Fook Nominee Ltd.

The sale raised about HK$19.4 billion, accounting for only about a half of the H-share financing budget of 30 billion yuan approved earlier by regulators.

"We are not going to use the rest of the quota," said Ren Huichuan, Ping An's general manager.

UBS Securities wrote in a report that the rights issue will meet Ping An's capital demands over the next 12 to 18 months but whether it will satisfy the insurer's demands over the next two to three years is subject to market conditions.

Ping An's H-shares rose 2.8 percent on Wednesday to HK$77.15, the biggest gain in more than a month, paring this year's loss to 11 percent.

Ping An's larger Chinese rival, China Life Insurance Co, which reported a 2.3 percent increase in profit last year, gained 2.3 percent.

The insurer's solvency ratio, which measures the ability to settle claims, had dipped more than 30 percentage points to 197.9 percent as of Dec 31.

The insurer said in September that it would pay 29.1 billion yuan to take control of Shenzhen Development Bank Co and enhance its banking operations.

The deal, along with a full-year dividend distribution of 0.55 yuan for each share, helped drag down its solvency ratio, the company said.

"The decline (in the solvency ratio) doesn't mean we are short of capital. In fact we meet the higher end of the capital requirement set by the regulators," said Ren.

The China Insurance Regulatory Commission set 100 percent as the minimum requirement for a sound solvency ratio, but only companies with a ratio higher than 150 percent are allowed to invest in real estate and unlisted firms.

Funds raised in the H-share rights issue will mainly be used to replenish the capital base of Shenzhen Development Bank, whose expansion has been constrained for years by a capital shortage, said Ren.

"One of the focuses for our business this year is to merge Shenzhen Development Bank with our current banking business," he said.

In 2010, property insurance premiums jumped 61.2 percent to 62.5 billion yuan.

The non-life business saw its combined ratio - which measures claims and expenses as a percentage of premiums earned - cut by 5.4 percentage points last year to a record low of 93.2 percent.

Net investment income, which mainly includes interest and dividends, rose 34 percent to 25.3 billion yuan over the same period.

Hu Yuanyuan contributed to this story

China Daily

(China Daily 03/31/2011 page16)