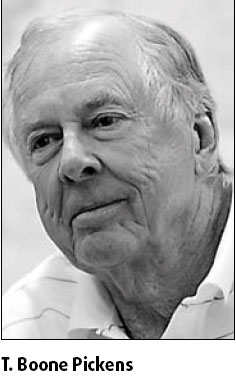

Pickens expects oil price to stay around $100

Legendary oil investor T. Boone Pickens, who made more than $1 billion in 2006 by betting on rising oil prices, said he expects oil prices will hold near or above $100 a barrel for the rest of this year.

He added that he made "a mistake" when his fund shorted the energy market at the beginning of this year as crude prices surged to new peaks.

Pickens, who heads the BP Capital hedge fund, told CNBC television he thinks oil will "hang around" $100 in the second quarter and that "in the second half we'll see above $100" because of strong fundamentals.

"I still am a fundamental player and I'm going to play the fundamentals until I'm told there's another way to evaluate the market," he said.

Pickens said global energy demand growth remained strong despite a US economic slowdown and that energy companies were having a hard time finding and developing new reserves.

"The major oil companies have peaked on their production. It's awful hard for them to add to their reserves and their production," he said. "The major oil companies are in liquidation."

He added that OPEC producers, who have declined to raise production despite calls from consumer nations for more supply, were also likely to defend high prices.

"Look at the producer countries. They have all kinds of reasons to keep the price up and they're going to keep the price up," he said.

Crude oil for May delivery rose as much as $1.63, or 1.6 percent, to $102.85 a barrel, and was at $102.41 at 12:12 pm London time in electronic trading on the New York Mercantile Exchange.

Pickens said that it would take a much deeper economic downturn to pull prices back down to some of the lows around $50 a barrel seen early in 2007.

Agencies

(China Daily 03/27/2008 page17)