|

|

Models display jewelry pieces designed by TTF, a Shenzhen-based jeweler. Provided to China Daily |

With the rapid development of China's economy, Chinese consumers' appetite for jewelry has continued to grow, resulting in consistent sales growth in the domestic market.

In 2011, spending in China's retail jewelry market reached 40 billion yuan ($6.3 billion), making it the world's largest consumer market for platinum and jade, and the second-largest diamond jewelry consumer after the US. But in addition to being one of the world's largest jewelry consumers, China has gradually emerged as a competitive jewelry maker in the international market.

In fewer than 20 years, China's jewelry industry has grown rapidly, and Shenzhen, a booming city in South China's Guangdong province, has played a crucial role in leading this industry.

Thanks to the influence of Hong Kong's industry, the past two decades have seen Shenzhen evolve into China's jewelry capital. Since the 1990s, the city has been acknowledged as China's biggest jewelry manufacturing base and trade distribution center.

According to the Gems and Jewelry Trade Association of Shenzhen, more than 2,000 jewelry companies now call the city home, and their annual output value of more than 50 billion yuan accounts for more than 70 percent of China's overall jewelry production. In fact, the sales revenue of Shenzhen's jewelry enterprises is not just ranked first in terms of domestic market share, it makes up about one-third of China's total.

But jewelers in Shenzhen are no longer content to remain the largest outsourcing base for brands from Hong Kong or other parts of the world. They are trying to reshape old business models by investing heavily in branding their own independently designed products, aspiring to upgrade Shenzhen from an international hub of original equipment manufacturers to the birthplace of famous jewelry brands.

|

|

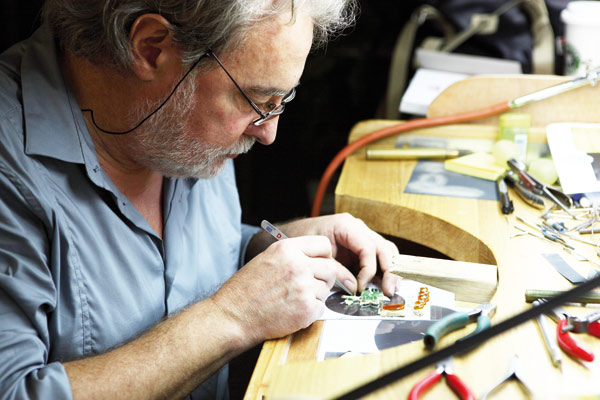

A French designer at TTF creates a jewelry piece. Provided to China Daily |

"China's jewelry industry is facing unprecedented development opportunities and its prospects are rosy, so it is the right time for Shenzhen to ride on the trend to cultivate its own famous jewelry brands," said Shi Hongyue, vice-chairman of the Gems and Jewelry Trade Association of China.

Shi said that while an exquisite platinum necklace made by a Shenzhen jewelry company is currently cheaper than a silver necklace from Tiffany or Cartier, the huge price gap reflects not only the fine craftsmanship and superb quality of Western jewelry, but most importantly, the gap in brand awareness.

"Promoting our own branded jewelry will ensure Shenzhen's jewelry enterprises develop more sustainability by making products of higher added-value and reducing their dependence on orders from others," he said.

Shi said jewelers in Shenzhen should overcome bottlenecks constraining the development of the city's jewelry industry to achieve a better brand-building result.

"Even though Shenzhen has the craftsmanship to deliver the orders of top international brands, its local brands lack independent research-and-development capability and lag behind their international counterparts in design," he said.

"A price war is an unsustainable market strategy; enhancing the capability of design innovation as well as strengthening brand-building efforts are vital for Shenzhen jewelers to gain a stronger foothold, given the increasingly intense market competition."

Some jewelers in Shenzhen have taken the lead in brand-building campaign. One of the most successful is Chow Tai Seng Jewelry Co Ltd, a large jewelry producer based in the city.

Established in 1966, Chow Tai Seng Jewelry is now one of the largest diamond-jewelry retailers and wholesalers in China. It currently has the largest jewelry chain in the country, with more than 2,000 shops in more than 300 Chinese cities.

The company posted sales revenue of 13 billion yuan in 2011, accounting for 7.1 percent of the market. Zhou Zongwen, board chairman of Chow Tai Seng Jewelry, said sales this year are expected to increase by about 30 percent over the previous year, and the company will maintain this robust growth momentum in the next few years.

Zhou attributes his company's strong sales performance to its huge brand-building efforts over the past five years, which he believes have greatly sharpened his products' market competitiveness.

"Brand building has a pivotal role for the expansion of consumer groups and market influence as well as increasing customer loyalty," he said.

"Higher brand awareness can help a jewelry company produce products with higher added-value so as to gain more gross profit. That is why Chow Tai Seng has developed by leaps and bounds in recent years because more consumers recognize our brand."

Zhou said China's major jewelry companies have been gradually accelerating the pace of brand building because they have realized that competition between jewelry enterprises in the future will be a contest of brand promotion.

More and more international jewelers are eyeing China's huge market, but instead of worrying about the challenge, Zhou believes their entry has provided an excellent opportunity for domestic jewelers to learn about branding from their Western counterparts.

"Some centuries-old European jewelry brands have advanced brand marketing, positioning, promotion and packaging knowledge, which is well worth learning for Chinese jewelers," Zhou said.

But, he explains, apart from learning from Western competitors, brand building also needs time and patience.

"Brand building is not an overnight thing, it needs long-term planning and sustained investment and a clear brand-positioning strategy," Zhou said. "I hope that by 2020, Chow Tai Seng could be a brand that is more recognized in the international market."

Apart from strengthened brand-building efforts, Shenzhen's jewelry companies have also enhanced their design capability.

"If we just copy outstanding design works from others instead of sharpening our own R&D capability, our company's development cannot be sustained," said Zhou Huawei, marketing manager of Shenzhen EDL Jewelry Ltd, a company specializing in the production and processing of gold and platinum jewelry.

Zhou said EDL got its start in the jewelry OEM business in the 1990s, producing equipment for big-name Chinese or overseas jewelry brands, but in recent years the company has focused on the promotion of their own branded jewelry.

"With rising living standards, people will pay more attention to design and workmanship, especially fashion-conscious people who are in pursuit of style and personality, so we must constantly make upgrades to our product design to meet the changing market demand," Zhou Huawei said.

At the same time, he said EDL also tries its best to catch up with the trend of international jewelry design.

"We hire designers from Italy, which is an important way for us to learn advanced design concepts from our Western counterparts," Zhou said, adding that China is now experiencing a severe shortage of quality jewelry designers, so experienced designers from the US or Europe are in high demand.

However, despite the difficulties, industry experts are optimistic about the prospects of Shenzhen's jewelry industry.

"In the next 10 years, you could see the emergence of the equivalent of top Western jewelry brands in Shenzhen," said British luxury jewelry designer Theo Fennell, whose clients include Victoria Beckham and Helen Mirren.

"Chinese jewelers should have more confidence because many Western brands are making things in China and then they bring them back, so there is no shortage of skills," he said.

"Gucci was a local company that used to make saddles and shoes and now it is an international brand, so before a small business develops into a huge empire, it has to start from somewhere."

Fennell said that as Chinese people get richer, they will look for jewelry of better quality and design, which will force a Chinese local company to enhance their production skills.

"Over time, Shenzhen will prove to the world that it is the cradle of world-class jewelers," he said. "It is only a matter of time before an international jewelry brand emerges from Shenzhen."

Contact the writer at liulu@chinadaily.com.cn