|

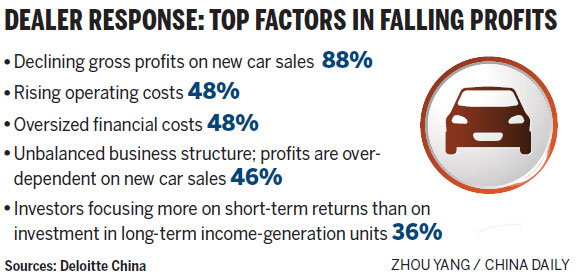

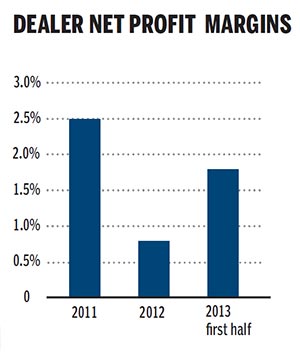

With inventories rising amid an intense price war, auto dealers in China are having a tough time making a profit, according to a report by British consulting firm Deloitte.

Dealer margins are hurt by their heavy reliance on new vehicle sales, a challenge compounded by rising operational, labor and financing costs, said the report based on surveys and in-depth interviews with dealers.

The report said one cause for dealer doldrums is the low percentage of revenues from parts and after-sales services.

|

Statistics also show that the ratio of dealer overheads - which include expenses in sales, management and financing - was more than 7 by the end of 2013, up 1 percent from the previous year.

Since 2011, Deloitte has researched and surveyed auto dealer performance to provide insights about the risks and challenges in the industry. It then formulates strategies to address problems.

Its latest report was based on a questionnaire and nearly 100 interviews with executives at auto dealers and carmakers in China.

"While auto sales will be buoyed by sustained economic growth, the structure of the auto market is not mature, compared with the Western world," said Winhon Chow, a managing partner at Deloitte China.

"Heavy reliance on new car sales can leave overall profitability exposed to uncertainties in the external environment. There is a long way to go for the profit structure to tilt toward the back-end segments (of parts and services). Chinese auto dealers also need to bear the brunt of increased overheads."

After years of rapid development, the Chinese auto market began to slow in 2011. In the wake of the global economic recovery, there has been a moderate but steady rebound over the last three years.