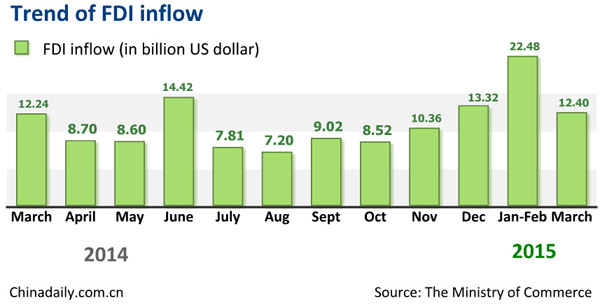

BEIJING - Foreign direct investment (FDI) in the Chinese mainland jumped 11.3 percent year on year in the first three months of 2015, settling at $34.88 billion, the Ministry of Commerce (MOC) announced on Thursday.

The pace slowed from the 17 percent increase registered in the January-February period. However, it far exceeded the annual growth rate of 1.7 percent posted for 2014.

Service industry FDI totaled $21.59 billion in the first quarter, up 24.1 percent year on year. This accounted for 61.9 percent of all FDI during the period. In the service sector, financial, distribution and transport services attracted the most investment.

Manufacturing FDI was down 3.6 percent year on year to $11.22 billion during the period. It accounted for 32.2 percent of the total FDI.

January-March, FDI into China's eastern regions grew 18.8 percent year on year to $29.78 billion, while FDI into the central and west fell 26 percent and 15.2 percent respectively to $2.67 billion and $2.43 billion.

Along with the FDI surge, the number of newly registered foreign-funded companies increased 22.4 percent in the first three months to 5,861, the data showed.

China's Hong Kong Special Administrative Region (SAR), the Republic of Korea, China's Taiwan, Singapore, Japan, the U.S., Germany, Britain, France and Saudi Arabia were the top ten contributors during the period.

A revised industrial catalogue for overseas capital took effect on Friday, cutting the number of industries in which companies must have Chinese investors in order to be authorized from 43 to 15. The number of industries in which companies must have Chinese investors holding controlling stakes was cut from 44 to 35.

The new catalogue encourages overseas investors to invest in high-tech sectors such as modern agriculture, advanced manufacturing, energy savings and environmental protection, new energies and other modern services.

Thursday's data also showed outbound direct investment (ODI) by non-financial firms surged 29.6 percent to $25.79 billion in the first quarter.

China's overall ODI accumulated to $672.1 billion by the end of March.

China has become a net capital exporter for the first time, with ODI outnumbering capital inflows in 2014.

China's accomplished turnover of foreign contracted projects increased 17.6 percent to 194.69 billion yuan ($31.76 billion) in the first three months, said MOC spokesman Shen Danyang.

Meanwhile, the total contract value of executed outsourcing contracts with Chinese-based service providers was at $18.55 billion, up 12.6 percent year on year.