|

Iron ore imports are expected to grow 6.4 percent year-on-year to around 1 billion metric tons in China during 2015, driven largely by lower commodity prices and growth in domestic demand, industry experts said on Wednesday.

The growth rate is significantly lower than the estimated 14.7 percent increase in 2014, according to a report released by the China Metallurgical Industry Planning and Research Institute.

Although the GDP growth rate of the world's second-largest economy will decline as the country restructures its growth mode, domestic steel output and demand will increase next year, which will lead to higher iron ore imports, said Li Xinchuang, deputy secretary-general of China Iron and Steel Association and president of the institute.

"The falling iron ore price is another incentive for rising imports," Li said.

He said iron ore prices will stay low at around $70 to $80 a metric ton next year and are unlikely to fall below $60 a ton.

According to a report released by the institute, iron ore imports by China during 2014 are estimated to be around 940 million tons, a 14.7 percent growth over the levels in 2013.

Li said the world's top four miners-Rio Tinto Plc, BHP Billiton Ltd, Fortescue Metals Group Ltd and Vale SA-can still make profits when even iron ore prices fall to $60 a ton, while the same could put a number of Chinese iron ore mines into bankruptcy.

Rio Tinto, which has charted a capacity expansion plan from its current 290 million tons to 360 million tons by mid-2015, has low iron ore costs of around $40 a ton, according to Andrew Harding, chief executive of the company's iron ore business.

The National Development and Reform Commission, the country's economic planner, has approved several railway and airport construction projects, with a total investment of 700 billion yuan ($114.2 billion), since October, which will keep steel demand robust in the long term, said Zhou Wei, an analyst with the Beijing-based Lange Steel Information Research Center.

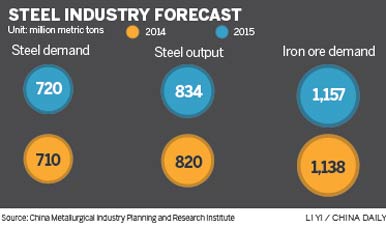

According to the institute's report, steel demand in China will reach 720 million tons in 2015, representing an annual growth of 1.41 percent, and the country's crude steel output will be 834 million tons, a year-on-year increase of 1.71 percent.

"Real estate and infrastructure construction investments will see slower growth next year as the nation takes steps to ease the overcapacity problem in many industries and trim inventories, which will lead to a slower growth in steel demand," said the report.

Demand for steel in the construction sector is estimated to be about 395 million tons next year, up 1.28 percent year-on-year. Steel demand for machinery manufacturing is estimated to be 144 million tons, a 3 percent rise over 2014.

Boosted by more natural gas pipeline construction, the energy sector will have steel demand of 33 million tons, an annual growth of 3.1 percent. The shipbuilding market will remain gloomy in 2015, creating steel demand of 13.5 million tons with year-on-year growth of 3.8 percent.

Most Chinese companies have been actively tapping overseas markets in recent years with high-end steel products. Hebei Iron and Steel Group Co Ltd signed an agreement with Switzerland-based Duferco International Trading Holding to acquire 51 percent of the latter's shares in mid-November.

Yu Yong, president of HBIS, said the "going out" strategy is a better way out of the current domestic market and competition in the global market would prove beneficial for the company's development.