Second sovereign assessment helps lift credit agency's worldwide profile

Dagong Global Credit Rating Co Ltd has made its debut in Latin America's sovereign credit rating market, underscoring the growing need for risk ratings following a rush of Chinese investors in recent years.

The Republic of Suriname, a small South American nation that won its independence from the Netherlands in 1975, appointed Dagong to give it a sovereign rating, a move that analysts said was a bid to woo Chinese investors.

The intention was apparent at a news conference on Tuesday in Beijing in comments by the nation's central bank governor, Gillmore Hoefdraad.

"Working with Dagong broadens Suriname's exposure here in China. We understand that their measures of risk have a solid basis. It has been a very useful engagement since the very beginning. This for us is like a steppingstone to the financial sector, foreign direct investment and trade sector openness," he said.

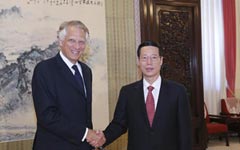

|

|

A spokesman for the agency told China Daily that the deal was sealed at the end of last year, and after an on-site inspection by Dagong's credit officers, the two sides decided to release the rating report following President Xi Jinping's landmark visit to Latin America.

Xi started his visit in Brazil on July 14 and then went on to Argentina, Venezuela and Cuba. The trip yielded the establishment of the BRICS Development Bank, as well as billions of dollars in agreements covering energy, infrastructure and resources.

The trip also highlighted China's growing economic clout in the region. From 2002 to 2012, China's trade with Latin America expanded 20 times to $261.2 billion.

China's outbound investment also surged in the region. The $83.4 billion in nonfinancial direct investment as of 2013 made the region China's second-largest overseas investment destination.

"Currently, China's trade and investment ties with Latin America concentrate on primary products. This will last a bit longer. But from the long-term perspective, it has to evolve to higher value-added sectors such as finance and technology," said Guo Cunhai, a researcher with the Institute of Latin America at the Chinese Academy of Social Sciences.

Suriname's relationship with China is a microcosm of China-Latin American ties. The country, with a population of just 560,000, is rich in natural resources such as gold, bauxite, oil and water.

"Relations between Suriname and China have been strengthening over the past 20 to 25 years. We have received quite a lot of support from the Chinese government, including concessional lending, infrastructure and social programs," said Hoefdraad.

Dagong assigned the country local- and foreign-currency sovereign credit ratings of BB+, each with a "stable" outlook. The report noted Suriname's gradually improving political stability and level of governance, but it also mentioned a "high risk of economic volatility stemming from its reliance on exports of primary products, as well as vulnerable fiscal and external positions that still lack a sufficient buffer".

Standard & Poor's Financial Services LLC and Fitch Ratings Inc assigned the country a BB- rating and a "stable" outlook.