BEIJING - China's economic growth is showing more recovery signs in the second quarter after a bumpy start in the beginning of the year, but renewed setbacks may come from the ongoing property downturn, according to economists.

China's growth accelerated to 7.5 percent in the second quarter of 2014, after dipping to 7.4 percent in the first quarter, latest figures from the National Bureau of Statistics (NBS) showed.

On a quarter-on-quarter basis, the economy expanded 2 percent in the April-June period, 0.6 percentage points faster than the January-March period.

The momentum brought year-on-year expansion in the first six months to 7.4 percent.

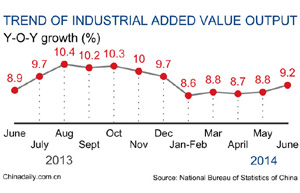

"The current summer recovery should help lessen pressures on policymakers to deliver more significant policy easing measures for the next couple of months," said Wang Tao, chief China economist at UBS. The economic growth rate was in line with major activity data, with a turnaround in exports, improvement in industrial production, and faster growth in infrastructure investment thanks to increased fiscal funding.

"With the latest result, there will be less of a rush to roll out more policy support," said Kevin Lai and Junjie Tang with Daiwa Capital Markets in a research note.

But economists warned of downside risk for growth from the property sector.

There will be no shortage of challenges for the second half, especially from the property downturn and its potential spillover effects on a number of industries, said Lai and Tang in the note.

"The property sector slowdown seems to have moderated in June, but weak funding and sales growth still point to some downward pressure on the economy in the second half," according to an HSBC research note written by economists Qu Hongbin and Julia Wang.

NBS data showed funding growth for property firms slowed to 3 percent year on year in the first half, as compared to 6.6 percent in the first quarter. Floor space of commercial buildings sold during the six-month period dropped 6 percent year on year, compared to a decrease of 3.8 percent in the first quarter.

"Despite relative stabilization in the second quarter, the worst of China's property downturn is not yet behind us," said Wang Tao.

"Weak market sentiment and sluggish sales, rising inventory and increasing financing difficulties in the property sector will all continue to weigh on the industry's outlook as we approach the last quarter of the year," said Wang.

In terms of policy outlook, J.P. Morgan's chief China economist Zhu Haibin said the positive developments will lead policymakers to follow the current fiscal and monetary policies, spend more efforts in structural reform, and grant targeted support to certain industries.

"As the government tries to strike a balance between reforms and restructuring on the one hand, and growth on the other, any upcoming easing measures will likely continue to be fine-tuning," said Wang.

|

|

|

| China's H1 industrial value added up 8.8% | China's H1 retail sales up 12.1%?? |