|

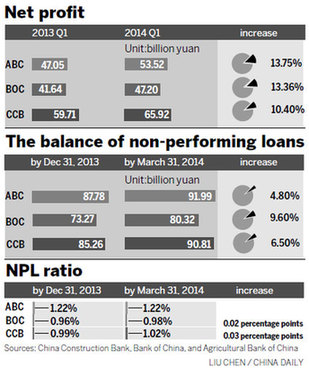

Major domestic banks have experienced significant increases in nonperforming loans, their first-quarter results show.

China Construction Bank Corp had 90.81 billion yuan ($14.52 billion) in NPLs as of March 31, up 5.54 billion yuan from the end of 2013. The NPL ratio climbed 0.03 percentage point to 1.02 percent.

Bank of China Ltd had an NPL balance of 80.32 billion yuan, up 7.05 billion yuan, and its NPL ratio rose 0.02 percentage point to 0.98 percent.

Agricultural Bank of China Ltd's bad loan balance increased 4.21 billion yuan to 91.99 billion yuan, while its NPL ratio held flat at 1.22 percent.

China Minsheng Banking Corp Ltd, the nation's first privately owned lender, had an NPL balance of 14.15 billion yuan, up 749 million yuan. Its NPL ratio went up 0.02 percentage points to 0.87 percent.

"Compared with the previous two years, such a considerable increase in non-performing loans in the first quarter is unusual for the Chinese banking sector," said Ni Jun, an analyst at Shanghai-based Greenwoods Asset Management Ltd.

For example, ABC's bad loan balance was 85.68 billion yuan in the first quarter of 2013, which was a decline of 165 million yuan from the end of the previous year. The NPL ratio dropped 0.06 percentage point to 1.27 percent.

PBOC suspends use virtual credit card |

Alipay to issue online credit cards |