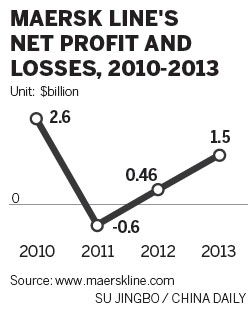

Despite being challenged by a still weak global shipping market, Maersk Line achieved a profit of $1.5 billion from the world market in 2013, up from $461 million a year earlier, thanks to vessel network efficiencies and lower bunker prices.

Large Chinese shipping companies such as China Shipping Container Lines Co and China Merchant Energy Shipping Co reported a net loss of 2.65 billion yuan and 2.18 billion yuan respectively in March. Chang Jiang Shipping Group Phoenix Co, another large Chinese shipping company, is highly likely to be delisted from the Shenzhen Stock Exchange this year after suffering losses for three consecutive years.

"Regarding container transportation, we believe the current focus on becoming an increasingly consumption-driven economy holds great potential for our industry," Eskelund said

"While trade growth in China today may no longer reach the double-digit percentage levels of past years, trade growth in absolute terms will still be significant."

Maersk Line, Mediterranean Shipping Co SA of Switzerland and French carrier CMA CGM SA agreed last year to establish a long-term operational alliance on East-West routes to optimize resources and lower the cost of container shipping. Known as the P3 Network, it is planned to start operating in the second quarter of 2014 if approval is obtained.

Luo Renjian, a researcher at the institute of transportation research under China's National Development and Reform Commission, said it is not unusual for major international shippers to form a bigger union under today's global trade environment because others are dominated by large alliances such as CKYHE and G6 in the world market, which were formed in 2005 and 2011, respectively.