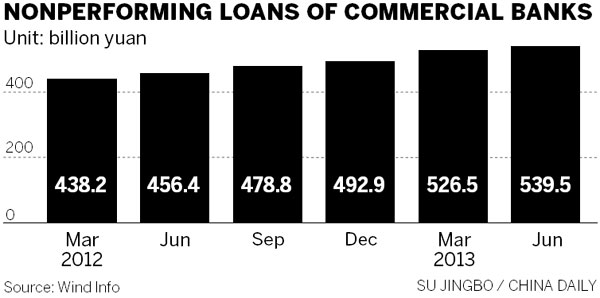

"NPLs are under pressure as economic growth slows, but high levels of loan loss reserves may provide a cushion," wrote Christine Kuo, vice-president and senior credit officer of the financial institutions group, Asia-Pacific, of Moody's Investors Service in a recent note.

According to lenders' financial statements to the CBRC, as of end-June, the average NPL ratio was less than 1 percent.

The average loan loss reserve was about triple the level of NPLs.

Writing off the worst of their bad debts will allow lenders to mitigate surging NPL ratios amid rising defaults. Regulators have eased rules for debt write-offs to small businesses since 2010, and policymakers have ordered lenders to improve their risk buffers.

In April, the CBRC urged lenders to increase provisions for defaults, write off some bad loans and curb dividend payments while earnings are ample to create a cushion in case of an economic slowdown.

Analysts said that lenders need to improve their risk management skills and pricing capabilities under the increasing pressure of souring debts and contracting profit margins as interest rates are liberalized.

"The liberalization of interest rates demands a higher level of banks' competence in asset and liability management and interest-rate management. Both the current management models and the interest-rate gap management tools need to be re-tailored to cope with the dynamic changes in assets and liabilities, so that banks can effectively manage the interest-rate gap and structural risks," said Jimmy Leung, PwC banking and capital markets leader for China.

"Banks also need to improve their pricing capabilities and optimize their risk management competence, preparing for the final phase of the liberalization in deposit rates," said Leung.

ABC's other latest news

Agricultural Bank to open branch in Frankfurt

Agricultural Bank sees profit rise

Agricultural Bank of China Q1 net profit up 8%

We further recommend

Li pledges to strengthen debt audits

Banks 'seeking to transfer non-performing loans'

Major banks reveal Central Huijin investment

World's first 1-liter car debuts in Beijing

World's first 1-liter car debuts in Beijing

Paper-made furniture lights up art show

Paper-made furniture lights up art show

Robots kick off football match in Hefei

Robots kick off football match in Hefei

Aerobatic team prepare for Aviation Convention

Aerobatic team prepare for Aviation Convention

China Suzhou Electronic Manufacturer Exposition kicks off

China Suzhou Electronic Manufacturer Exposition kicks off

'Squid beauty' and her profitable BBQ store

'Squid beauty' and her profitable BBQ store

A day in the life of a car model

A day in the life of a car model

Vintage cars gather in downtown Beijing

Vintage cars gather in downtown Beijing