August saw the central government collect less monthly income year-on-year for the first time in 2012 as the country's economy continued to weaken.

The central government collected 376.5 billion yuan ($59.5 billion) in fiscal revenue last month, 6.7 percent less than in the same month a year ago, the Ministry of Finance said in a statement on Tuesday.

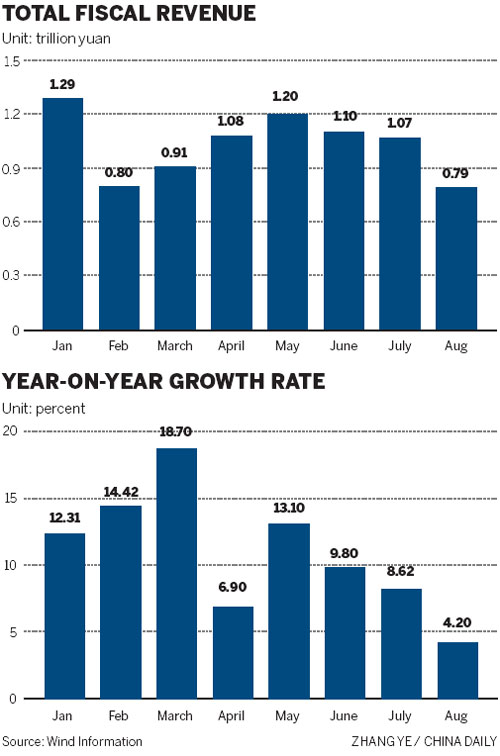

Despite the decline in the central government's collections, governments at all levels brought 4.2 percent more fiscal revenue year-on-year in August, 786.3 billion yuan in total.

In the first eight months, the country's fiscal revenues increased by 10.8 percent year-on-year, rising to 8.23 trillion yuan. Even so, that rate of increase was down 20.1 percentage points from the same month in 2011.

"The slower growth was attributed to the slowing economy, falling prices and structural tax reductions," according to the statement.

Liu Shangxi, deputy chief of the Ministry of Finance's research institute for fiscal science, said collections of fiscal revenue are a key barometer of China's economy.

The country's economic growth fell to a three-year-low of 7.6 percent in the second quarter of this year, and some analysts speculate the downturn will persist into the coming months.

Liu cited two chief reasons why collections of fiscal revenue are increasing at a slower pace: the sluggish industrial sector and a lower demand for exports.

In China, a large portion of total tax revenues come from value-added taxes, which are mainly levied on manufacturers. August saw 179.3 billion yuan worth of those taxes collected, an amount down 8.5 percent year-on-year.

Meanwhile, export tax rebates, an indicator of export volumes, was down 11.4 percent year-on-year to 77 billion yuan.

"Considering the weak economic growth in the third quarter, fiscal revenue may dip further in September," said Peng Wensheng, chief economist with the investment-banking company China International Capital Corp Ltd.

Despite the decrease in the central government's collections, the income brought in by local governments went up by between 10.2 percent and 16.8 percent from July to August, the Finance Ministry said.

"These rapid increases still being seen in the collection of local fiscal revenue may pose a threat to the real economy," Peng said. "It suggests that the authorities are working harder to collect taxes."

One boon for local governments has been non-tax revenues, which were up by 31.6 percent year-on-year in August.

The Ministry of Finance said the increase resulted in part from those governments collecting more revenue from sales of mining rights, as well as taking more steps to strictly collect charges imposed on the use of State-owned resources.

The first eight months, meanwhile, saw revenue from land sales, an important source of income for local governments, decrease by 26.1 percent year-on-year to 1.56 trillion yuan.

Liu said the world's second- largest economy is in the midst of a transformation in which advanced enterprises are not being started as quickly as older ones are being eliminated. Fiscal revenue may therefore continue to increase at a relatively slow pace far into the future.

"The government should cope with this 'tough situation', first of all, by cutting administrative expenses," he said.

On Tuesday, Premier Wen Jiabao said the government still has "ample" room for maneuvering in terms of its fiscal and monetary policies.

By the end of July, China had a fiscal surplus of 1 trillion yuan, as well as more than 100 billion yuan in a stability adjustment fund. Both of those pots of money can be used to stimulate the economy, Wen said.

The country made 7.24 trillion yuan in fiscal expenditures in the first eight months, up 21.8 percent from the same period a year earlier.

Peng said the government will spend more than 2 trillion yuan in the rest of the year, and that more capital will be put toward the private sector and infrastructure projects.

weitian@chinadaily.com.cn

Washington to remain focused on Asia-Pacific

Washington to remain focused on Asia-Pacific RQFII target blue chips amid bear market

RQFII target blue chips amid bear market Australian recall for top two exporters

Australian recall for top two exporters China fears new car restrictions

China fears new car restrictions