|

|

|

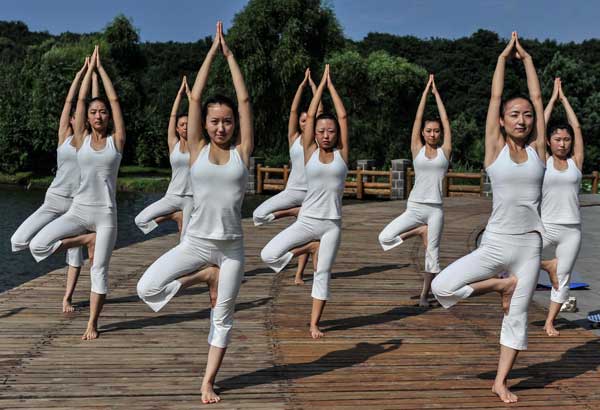

Women practice Yoga in Changchun, Jinlin province, August 8, 2012. [Photo/Xinhua] |

Given their overheads, the more seriously affected have been the chains.

In the decade since first appearing on the scene in 2001, CSI-Bally, a joint venture between State-owned China Sports Industry Group Co Ltd and US-based Bally Total Fitness Co, was reported to have become a company with sales exceeding 100 million yuan ($15.69 million).

But by 2009, that turnover had dropped to 65 million yuan and was still dropping.

CSI-Bally's gross profit margin dropped to 3.87 percent last year, from 43 percent in 2006.

It currently has 24 gyms in 13 cities in China, but was spending a lot more than it was making, experiencing an operating deficit of 64 percent in 2010.

Similarly, rival Nirvana has suffered and was reported to have recorded losses of 17 million yuan in 2009 and 9 million yuan in 2010.

Operators claim the increased losses are coming from higher rents - which account for about half the cost of a typical gym - and increased wages, according to Wang Cheng, general manager of Nirvana, which has 13 outlets in eight cities.

Using the example of Nirvana's outlet on Beijing's Chang'an Avenue, rental there was reported to have jumped to 7 million yuan last year, from 2.5 million yuan in 2007.

The monthly cost of the type of qualified coach needed to be employed in the larger chains has also doubled in the past five years, to 1,000 yuan, said one Hosa manager who refused to be named.

At the same time, the arrival of many smaller players onto the market has sparked a price war that is squeezing margins further.

The latest industry estimates suggest there were more than 1,000 fitness centers registered in Beijing between 2006 and 2008, but four years on, large numbers have disappeared.

Discounting has become the major tool of the fitness industry to win back business.

"Price wars were first kicked by the small operators, and they forced middle-level players to follow, then the big companies had to adopt the strategy too.

"We soon realized that Chinese consumers have very little brand loyalty when it comes to fitness," said Luo Juan, "and many were simply following price".

Tao Yingjian says her price of fitness - as opposed to many other trappings of a good life - has been dropping in the years she's been going to a gym.

"I bought my first yearly membership in 2006 at Hosa Fitness Club and it cost 8,000 yuan; today you don't have to spend any more than 4,000 yuan, even for the big fitness chains, including Nirvana, CIS-Bally and Powerhouse (International Fitness Chain)," she said.

The fitness chains all offer promotional campaigns, such as "buy-two-get-one-free", group purchasing, holiday discounts, and free trials.

Luo added that the need to keep fit hasn't changed among Chinese consumers, but many are realizing they don't have to pay a lot for it, and very often, if people look hard enough, what's on offer can be free.

Despite rising popularity of gyms, the vast majority of those taking regular exercise remains the over-50s, he said, who don't use gyms, preferring instead to jog or do exercise in groups in public parks.

All over the country, the central government has been installing free exercise equipment in many residential communities, which attract all kinds of people who want to exercise, but have no time or are reluctant to go to gyms.

Washington to remain focused on Asia-Pacific

Washington to remain focused on Asia-Pacific RQFII target blue chips amid bear market

RQFII target blue chips amid bear market Australian recall for top two exporters

Australian recall for top two exporters China fears new car restrictions

China fears new car restrictions