|

|

Officials say China has built up its largest ever cotton stockpile over the past two decades as a precaution against a likely large reduction in cotton acreage this year and ensuing price fluctuations.

As much as 3.13 million metric tons of domestic cotton have been accumulated over the seven-month period that ended on March 31, according to the China Cotton Association.

The stockpile this year has been the largest since 1984, said Gao Fang, executive vice-president of the association. It was accumulated to prevent possible price rises at a time when the country's cotton acreage is expected to decrease 16.7 percent year-on-year.

Some Chinese cotton traders also fear that cotton prices will increase in the global market later this year. That could be fueled by price inflation in the United States, even though new supplies of the crop are expected to come from Africa and other developing economies.

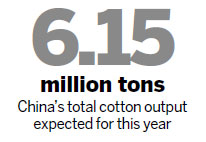

The likely decrease in acreage could result in China harvesting 1.23 million fewer tons of cotton this year, meaning amount of cotton it produces would be around 6.15 million tons this year, compared with 7.38 million tons last year.

The global acreage for cotton is expected to decline by 9 percent in the 2012-13 season after jumping to record highs in the 2010-11 season, according to industry experts.

In recent years, China has consumed about 10 million tons of cotton on average annually. More than 60 percent of that has come from domestic cotton farms and the rest from imports. The massive Chinese textile industry uses up half of that total in producing garments for export.

The country saw a wild rise in cotton prices in 2009, when its cotton acreage declined by 13 percent from the previous year. The domestic spot price for the commodity surged to a historic high of 40,000 yuan ($6,250) a ton shortly afterward, causing the global cotton price to surge to a new high in early 2010.

In 2011, though, the price tumbled. China National Radio reported that Liu Hongju, a cotton farmer in Shandong province, has seen the selling price of her harvest decrease by more than 40 percent from what it had been in 2010. "We've been busy for nothing this year," she was quoted as saying.

Grain farmers, in contrast, can count on commanding better prices for their products and receiving greater incentives from the government, according to a China Cotton Association survey of farmers' planting intentions in February.

In Liu's hometown, Dezhou, cotton acreage has been reduced by half, from 200,000 hectares a few years ago to 100,000 hectares in 2011, according to Ma Junkai, from the local cotton association.

Ma said 2012 would see the regional cotton acreage decrease by a further 20 to 30 percent.

Of China's three chief areas where cotton is grown, the Yellow River valley, including Shandong province, is expected to see the largest reduction in cotton acreage. The survey predicted it will decrease by 27 percent year-on-year.

The acreage in the Yangtze River valley is meanwhile expected to decrease by 13 percent year-on-year, and that in Northwestern China, primarily in the Xinjiang Uygur autonomous region, by 7.3 percent.

Much of the farmland that is cleared of cotton in the Yangtze and Yellow valleys will instead be sown with grain, which requires less work and time to cultivate and is likely to be supported by greater government subsidies, according to the survey.

Gao said the survey merely sheds light on farmers' initial plans and that it is too early to know how many acres of cotton will actually be planted, although it is almost certain that the crop's acreage will decrease.

If this year's cotton harvest conforms to the survey's indications, and if the market is awash with easy credit, China will be under huge pressure to curb a surge in cotton prices that is expected to come along later this year, said Ma Wenfeng, a senior analyst at Beijing Orient Agribusiness Consultant Ltd, one of the largest consultancies in the industry.

Some say the government should take steps to prepare for the expected drop on production. With less cotton in the market, there is little doubt the crop's price will increase. And if credit continues to be easy to obtain, as was the case in 2009, speculation could push cotton's price upwards, Ma said.

If that happens, he said, it is only by having a large stockpile of the crop that the government can maintain market stability.

Those in business circles have been calling for incentives to spur China's economy along. The country's GDP growth rate went down to 8.1 percent year-on-year in the first quarter, from 8.9 percent in the last quarter of 2011.

Foreign trade, meanwhile, is in a rocky situation. The country's export growth rate fell to 8.9 percent year-on-year in March from 18.4 percent in February. And its rate of import growth underwent an even more serious change, going to 5.3 percent year-on-year in March from 39.6 percent in February, according to the General Administration of Customs.

Inflation, though, is no longer accelerating as quickly as in last year, said Lian Ping, chief economist at Bank of Communications Ltd, predicting that decision-makers will gradually loosen the country's monetary policy. And that, as both Chinese and international bankers expect, will lead the central bank to further reduce the reserve requirement ratio, the amount of money that banks must set aside.

Some economists said China may be luckier this year than in 2009.

Zhang Lijun, a Nankai University professor and business consultant, said the current sluggish demand for textiles, especially from the eurozone, has resulted in fewer orders for Chinese exports.

So the country may be able to make do with a smaller cotton supply after all. He predicted cotton prices will not begin to continuously increase until global demand is restored.

zhousiyu@chinadaily.com.cn