China's personal income tax has become a hot topic of discussion in recent years, as despite people's rising wages, inflation means people have less purchasing power.

Although, the threshold was raised to 3,500 yuan ($555.5) from 2,000 yuan last year, the higher threshold has not benefited everyone, especially those who work in smaller cities.

Even white-collar workers earning around 7,000 yuan a month in big cities like Beijing and Shanghai, where people pay large sums of money on accommodation, are complaining about the high cost of living.

Government statistics show that the average monthly wage in Beijing last year was 4,672 yuan, while for residents in Lanzhou, Gansu province the average monthly wage was 1,329 yuan a month. Hence a further raise in the threshold seems unlikely, given that any increase will not benefit those in medium and low-incomes areas, says Tao Ran, a professor at the China Center for Public Economics and Governance at Renmin University of China.

Especially those living in small cities where people's incomes are already often below the threshold and any raising of the personal tax threshold would be useless as a means of relieving their economic burden, says Tao.

Reforms in the future should focus on how to fully reflect a person's total income and ability to pay tax, says Zhong Jiyin, an economist at the Chinese Academy of Social Sciences. That means, the government needs to levy family-based income tax.

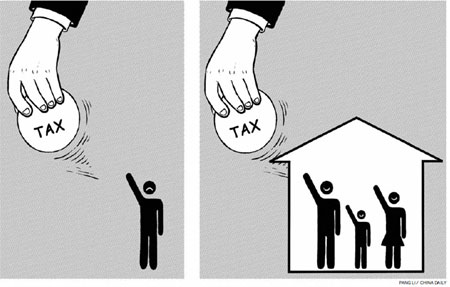

Taxpayers, even if they are around the same income level, have to deal with substantially different financial circumstances.

For example, a well-paid single white-collar staff and a senior manager who has to support his unemployed wife, child and parents not covered by pension system, both should pay a tax of 2,495 yuan for their monthly income of 17,500 yuan. The tax of 2,495 yuan will be trifle for the former but a heavy burden for the latter's family.

Different family structures will also lead to different tax sums. A couple who both earn 3,500 yuan a month don't have to pay tax. But in a different case, if the husband earns 7,000 yuan and the wife is jobless, they will pay 295 yuan in tax. Despite the same income, the two families differ on their disposable incomes.

Hence it's very important to levy income tax based on family income. The family-based income tax will better reflect one's ability to pay tax than the individual income tax.

But introducing family-based income tax will be a challenge, as it requires a complete overhaul of the current taxation system, says Yang Zhiyong, a researcher at the Institute of Finance and Trade Economics with Chinese Academy of Social Sciences.

Family-based income tax will require inter-departmental coordination to create a nationwide tax information database. The experiences of developed countries in levying family-based tax shows huge efforts must be made to determine a family's income sources and expenditures, such as the caring for elderly members of the family and paying for a child's education.

Moreover, after the database is established, it may be very complicated and difficult for authorities to verify information and calculate any possible tax deductions, Yang says.

There are also fundamental institutional barriers to overcome, Tao Ran says.

Introducing family-based income tax would mean all income sources would be put under much stricter supervision, bad news for those with vested interests, high incomes and special sources of income, and thus opposed by them.

But the government should try to overcome these obstacles as introducing family-based income tax would be fairer and help narrow the income gap.

The author is a writer with China Daily.

hebolin@chinadaily.com.cn