|

|

|

|

|||||||||||

|

Visitors to the Asian Business Aviation Conference and Exhibition talk in front of a billboard at the exhibition. [Photos / China Daily] |

China's business jet market could help propel the aviation industry

As the aviation industry in China is set to take off, Chinese and foreign companies are banking on the business of corporate aircraft.

"We are very optimistic about the prospect of China's business jet market. Compared to Europe and the US, this industry lags behind the economic level of China nowadays," said Du Jianyu, vice-president of Big White Bear Jet Co, Ltd.

Du's company was founded last year in Beijing, and focuses on aircraft management, charter flights and aircraft purchase consulting. It will become a member of China's business jet operators this year, an industry that currently has less than 20 players.

Right now, China doesn't play a significant role in the business jet industry. The number of registered business jets last year on the mainland was 132, less than 1 percent of that in the United States. But industry insiders expect the number to surpass 1,000 in 10 years.

The Chinese Luxury Consumer White Paper 2012, released last week by the Industrial Bank Co Ltd and the Hurun Report Research Institute, suggests that there are 63,5000 ultra-high net worth individuals with assets of more than 100 million yuan ($15.8 million), an increase of 10 percent compared with last year.

Makers and operators in the business jet industry are anxious to tap the consumption ability of the upper class. Since the idea of traveling via a business jet is still new to China, they are eager to promote their products and services to China's rich.

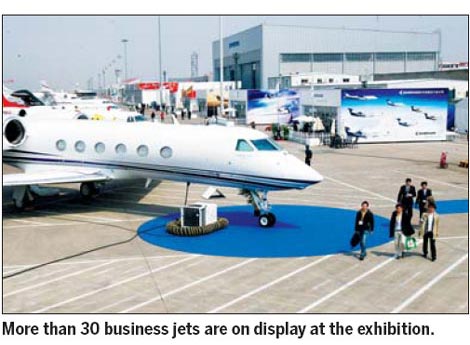

During the Asian Business Aviation Conference and Exhibition last week in Shanghai, more than 150 companies, most of which were from overseas, displayed more than 30 business jets and advertised their unique services.

|

|

Francois Chazelle, vice-president of Airbus, said that his company sold 10 business jets last year, half of them to clients in the Greater China area.

"For Airbus, China is the market with the fastest growth, and the speed is quite steady," he said.

Currently there aren't any companies in China that manufacture business jets. Aviation Industry Corp of China, the country's largest State-owned aircraft producer, announced recently that it will work with US-based Cessna Aircraft Co to manufacture business jets.

"I don't think China will have the ability to make business jets independently in 20 years, but there is huge room for doing operations business," Du said, hinting that Chinese companies have remarkable advantages in applying for flight routes and cost control in China than foreign operators.

Chinese authorities have promised to open otherwise tightly controlled low-altitude airspace in several cities and regions on a trial basis this year to boost the aviation industr.In China's 12th Five-Year Plan (2011-15), the central government said general aviation will be one of the pillars of the country's economic development. The plan calls for developing the industry, building a large number of airplanes and relaxing airspace restrictions. However, usually it takes days for the authorities to approve a flight application of a business jet.

But because of Du's previous experience in the aviation industry, he has a network of acquiantences to help him.

He also stressed that Chinese companies have big advantages in bringing down the cost that go with owning a business jet, such as housing or servicing an aircraft.

"We have our operation based in the mainland, and our planes can call most airports in provincial capitals, which will save a lot of money in plane maintenance," he said.

Companies outside of Chinese mainland are also determined to join the fierce competition.

"We recognize the importance of the Asian region to the future of business aviation and hope to build a stronger pool of client networks around the globe," said Bjorn Naf, CEO of Metrojet, a Hong Kong-based operator and maintenance provider of business jets. He said the company is considering opening offices on the mainland.

|

GE Capital Corporate Aircraft Finance, a wholly owned subsidiary of General Electric Co, has marched toward China's burgeoning business aircraft market.

"We're very confident that the China corporate aircraft industry will take off because of real demand from growing business activities and because they improve efficiency and productivity," said David Henderson, head of Origination Corporate Aviation Finance at GE Capital Asia.

As a key finance provider in the corporate aviation market, GE Capital Corporate Aircraft Finance has a global portfolio exceeding $9 billion and owns more than 2,000 aircrafts. With more than $25 billion in transactions funded worldwide, it has funded the purchase of more than 100 aircraft across seven countries in Asia.

Compared with local bank lenders that compete in the same arena, Henderson said he believes capital from GE will leverage the specialty and powerful resources it has in the aviation market to offer tailor-made financial solutions to customers.

Besides, financing the acquisition of a corporate aircraft by a specialist corporate aircraft financier can free up capital and banking lines that are better used for core business activity.

Terry Sharp, general manager marketing of GE's commercial aircraft programs, expects the number of business jets in China to reach 500 to 1,000 units in the next five years. As the number of aircrafts in China grows, more service companies will be necessary.

Honeywell Aerospace, one of the world's leading corporate aviation spare parts providers, recently announced the opening of a technical operations center at its Shanghai headquarters. The new facility allows service engineers to support technical inquiries, troubleshooting and documentation questions on the full range of Honeywell mechanical and avionic products.

"Though current fleets are relatively small, the high purchase plan level in China will generate significant new aircraft demand if realized," said Briand Greer, president of Honeywell's Aerospace Asia Pacific.

Contact the writers at xieyu@chinadaily.com.cn and hewei@chinadaily.com.cn