City explains housing rule 're-explanation'

Updated: 2012-03-01 09:22

By Hu Yuanyuan and Wang Ying (China Daily)

|

|||||||||||

|

A prospective buyer browses listings at a real estate agency in Pudong New District, Shanghai. Niu Yixin / For China Daily |

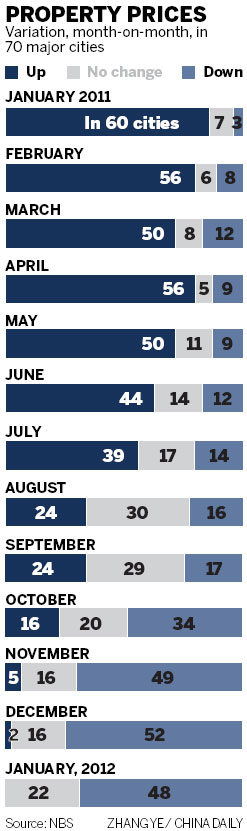

BEIJING/SHANGHAI - China's real estate policies will remain tight this year and the recent quickened pace of property transactions is not likely to last long, industry insiders said on Wednesday.

Their comments came about a week after widespread reporting on a so-called re-explanation of Shanghai's housing policy. The re-explanation, first made by an unnamed official in an interview reported by a local newspaper, suggested that people who have held Shanghai resident cards for more than three years will be allowed to buy a second home in the city.

On Tuesday, the Shanghai Municipal Housing Security and Administration Bureau posted a notice on its website, saying the city will enforce property regulations adopted by the State Council.

"The Shanghai municipal government will follow the measures and policies the country has adopted to control the property market, and our commitment toward returning property prices to reasonable levels is firm," the notice said.

|

|

Their latter statements contradict what an official from the same bureau had told the Shanghai Securities News in an article published on Feb 22.

"Ever since the home purchase restrictions have been put into effect, long-term holders of resident cards have been allowed to buy a second home, just as local Shanghai people do," said the official, who did not provide his name.

Liu Haisheng, head of the Shanghai Municipal Housing Security and Administration Bureau, said the city has not changed its restrictions on home purchases and will continue to follow policies the central government has adopted to restrain housing speculation and solidify the achievements of housing control.

The policies show the central government's determination to continue taking stringent measures to control real estate prices, said Carlby Xie, head of research at the real estate consultancy Colliers International (Beijing).

"Maintaining stability is the chief goal of local governments in the run-up to the two annual sessions in early March," said Zhang Hongwei, research director at Shanghai Tongce Real Estate Co Ltd.

"Any policy change made by local governments may prompt cities throughout the country to follow suit," said Zhang.

About 140,000 sq m in gross residential space were sold in Shanghai last week, marking a moderate recovery for property transactions.

"So a greater policy fine tuning is not needed," Zhang said.

Sales of property, including new and pre-owned homes, rebounded strongly in Beijing in February. By Feb 25, 9,117 new and pre-owned apartments had been sold, up 23 percent from the entire previous month, according to the municipal government.

Qin Lihong, executive director of the real estate company Longfor Group, said the company sold 1 billion yuan ($158 million) worth of apartments this past weekend. The last time that the company saw such good sales, Qin said, was a weekend in September 2010 - when the property market was much stronger.

"After a long period of playing wait-and-see, the pent-up demand of homebuyers who are buying houses for their own use recently found a release," Qin said.

"But this round of rebounds isn't likely to last a long time since these rigorous policies will stay around for a while."

Related Stories

Housing boom hits unlikely targets outside Beijing 2011-10-02 13:28

Public irate about villa subsidies for rich 2010-12-09 08:00

Affordable housing near for China 2011-10-10 20:15

Govt steps up push for subsidized residences 2011-10-02 07:16

Beijing wants private investments in public housing 2011-04-02 16:16

- Auction to boost shale gas exploration

- CSRC chairman calls for 'rational investment'

- NPLs will continue to rise in 2012: Analysts

- A life on the ocean wave

- Funds a problem for small businesses

- Medical care to improve through health cards

- Manufacturing continues to expand

- HSBC's China PMI reaches four-month high in Feb