Companies

CITIC to raise $322m in rights share issue

By Wang Ying (China Daily)

Updated: 2011-05-05 11:01

|

Large Medium Small |

BEIJING - CITIC Resources Holdings Ltd, a Chinese oil and coal producer with assets in Kazakhstan and Australia, is seeking to raise HK$2.5 billion ($322 million) through a rights issue to help fund expansion.

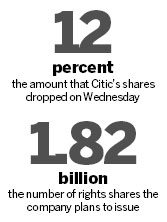

The company's stock fell the most in Hong Kong in more than two years after the former metal producer said it plans to issue 1.82 billion rights shares at HK$1.38 apiece on the basis of three rights shares for every 10 held. That's a 26 percent discount to the stock's closing price on Tuesday.

CITIC Resources is seeking to almost double oil output by 2014 from last year to help supply the world's fastest-growing major economy.

The unit of State-owned CITIC Group will use the proceeds of the rights issue to enhance its financial flexibility, fund investments and develop the Yuedong field, which will boost the value of its oil-assets portfolio upon full production, the company said in a statement on Wednesday.

| ||||

"There has also been some uncertainty in the company's production growth, and the rights offer will add to some investor frustration."

CITIC Resources expected Yuedong to produce 1.8 million tons a year by 2014, former Chief Executive Officer Sun Xinguo said in August. Output at the field in Bohai Bay, off China's northeastern coast, was expected to be about 60,000 tons in 2010, according to Sun.

Overall production reached 2.1 million tons last year. The company will increase output in 2011, CITIC Resources' Chief Executive Officer Zeng Chen said on March 28, without giving details.

Oil assets

The company's shares declined as much as 12 percent to HK$1.64, the biggest drop since Jan 8, 2009. The stock was trading at HK$1.66 at 3:02 pm local time, down 11 percent. The benchmark Hang Seng Index fell 1.5 percent.

The Chinese energy producer, which counts Singapore's state-owned investment group Temasek Holdings Pte as a shareholder, bought the Karazhanbas oil field in western Kazakhstan in 2007.

CITIC Resources may consider acquiring two or three oil assets in Asia and Africa to benefit from a recovery in crude prices, Sun said in March last year.

CITIC Resources has a stake in Brisbane-based Macarthur Coal Ltd, the world's largest exporter of pulverized coal used in steelmaking.

Bloomberg News

| 分享按鈕 |