Top Biz News

Venture capitalists funding more bio-pharmaceutical projects

By Xiao Ding and Wang Xiaotian (China Daily)

Updated: 2009-12-03 08:06

Spurred by the healthcare reform launched by the central government, healthcare has now become the hot destination for domestic and foreign venture capital (VC).

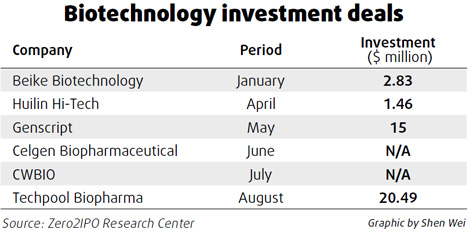

The buzz has been the most active in the bio-pharmaceutical sector which has raised funds to the tune of nearly $130 million in the first half of the year.

The sector accounted for 20 percent of the investment deals signed in China during the same period, according to a report by Zero2IPO, a leading domestic service provider for the venture capital and private equity industry.

"The ratio is pretty high. The passion (for bio-pharmaceuticals) has been ignited by the predictable growth potential in China's healthcare industry and the growing demand for biopharmaceuticals," said Zheng Yufen, senior manager for healthcare at the investment banking division of Zero2IPO.

"Talks are also on for a slew of other investment deals in the bio-pharmaceutical sector and hopefully they would be sewn up by the end of the year," she said.

"The bio-pharmaceutical segment often sees mega deals and would continue to catch the fancy of venture capitalists for some time to come."

In January, Kerry Bio-Science, a Zhejiang-based life science research pharmaceutical company, raised its second round of funding worth $13 million from KPCB China and some institutional investors. Kerry Bio-Science will use the funds to set up a new development and research center and expand its output capacity.

The Kerry Bio-Science deal sparked a flurry of investment in the bio-pharmaceuticals sector. Macrostat, a clinical research data provider on bio-pharmaceuticals, got investment, with no details available, from Tigermed Consulting and Qiming Venture Partners. In May, KPCB China made its second investment this year, in Nanjing-based Genscript Corporation, a leading bio-pharmaceutical research outsourcing company, at a price of $15 million, the largest this year.

According to Xiao Jun, executive vice-president of Genscript, the company got funding due to its "inherent strength in biotechnology research and its comprehensive service system".

"GenScript needs capital and mature management experience to help fulfill the goal of becoming a leading contract research outsourcing company," Xiao said.

"After China unveiled its healthcare reform, a huge potential for these products was unleashed," said Zheng.

Over the next few years, China's bio-pharmaceutical sector will continue to grow by 12 to 15 percent annually, and by 2010, the market will reach $100 billion.

With its strong talent pool, China is in a much better position to attract investment by international medical companies for R&D centers. In November, drug major Merck Serono and IBSA, a Switzerland-based bio-pharmaceutical company, announced plans to set up R&D centers in China.

Maurizio Dattilo, director of Strategic Marketing of IBSA, said: "China has a very strong scientific research team and employees to work for the R&D center."

This year, venture capital firms like International Data Group and SAIF are bolstering their teams and hiring more employees from hospitals and domestic bio-pharmaceutical companies.

"Both the companies are in negotiations for deals of over $10 million," said Zheng.