Center

Stocks rise for 6th day, regain 4,000-point foothold

By Li Zengxin (chinadaily.com.cn)

Updated: 2007-06-12 15:54

|

Large Medium Small |

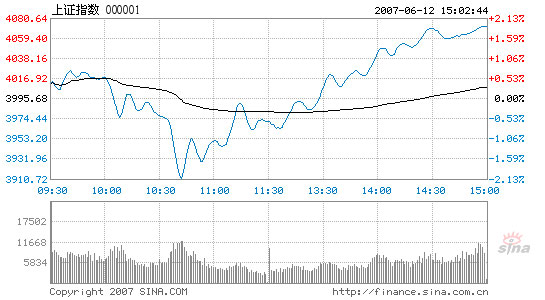

The release of a 3.4 percent rise in the consumer price index by the National Bureau of Statistics (NBS) this morning had little impact on the stocks, at least not for long.

The stocks responded by a few slides after opening higher from 4,011.68, the deepest seen at around 10:30, as the bench mark index dropped 60 points in minutes to touch the daily lowest point of 3,910.00. It then started to escalate in waves to cross the critical line again, and finish on an uprising path to just a little lower than today's highest 4,073.18.

Shanghai Composite Index

Source:www.sina.com.cn

Total turnover of the stocks enclosed by the major indices was 318.7 billion yuan, much larger than that of yesterday.

China Unicom, with the largest trading volume, slid 0.03 yuan, while Sinopec, with the largest transaction value, added 1.17 yuan to its share price.

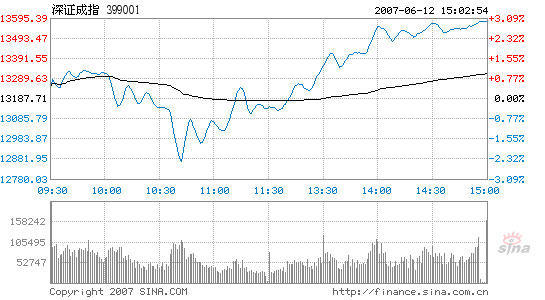

The Shenzhen Component Index, tracking the smaller Shenzhen Stock Exchange, closed at the daily highest point of 13,579.72, up 392.01 points or 2.97 percent. It toughed the lowest of 12,865.98 around the same time when the Shanghai index hit a bottom.

Shenzhen Component Index

Source:www.sina.com.cn

Of its A shares, 372 went up, 172 down and 67 unchanged. Sichuan Jinlu Group was on top of the gainer's list, while Shenzhen Century Plaza Hotel fell most. Anhui BBCA Biochemical, with the largest trading volume, rose 10 percent; while China Vanke, with the largest transaction value, slipped a little.

Stocks in the transportation, metal and hydroelectricity industries gained the most from today's trading. Shanghai Yatong climbed 10.06 percent up to pioneer the transportation and logistics sector. Paper makers also performed well.

B shares ended up. Of the 109 B shares listed on the two exchanges, 59 rose but 44 slumped. Shanghai Tire and Rubber surged 10.02 percent to lead the others on the B-share ranking list.

| 分享按鈕 |