Foreign banks upbeat on China business: Report

By Zhang Lu (China Daily)Updated: 2007-06-08 09:46

The business of foreign banks operating in China is booming and will continue to expand, with a growing Chinese middle class, soaring foreign investment and the opening up of the regulatory environment, says a recent report from PricewaterhouseCoopers (PwC).

The report, called "Foreign Banks in China", is based on in-depth interviews conducted between January and March with CEOs and other top executives of 40 foreign banks operating here.

These banks believe there's a huge development potential with China's rapid economic growth, with only a few predicting the country won't be able to maintain the strong growth until 2010.

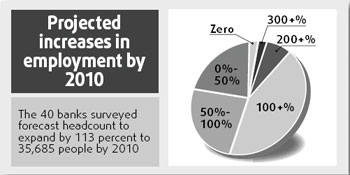

Over 80 percent of the banks surveyed said they expect their business in

China will grow by at least 20 percent this year.

Among them, four banks predict an annual growth rate of more than 100 percent and 10 anticipate a 50-100 percent growth in 2007.

For the period stretching up to 2010, only four banks forecast an annual growth lower than 20 percent.

In terms of profits, the report found that the performance of foreign banks has improved since 2005, when PwC's first survey on foreign banks in China was conducted.

Half of the respondents said their profits have been greater than expected during the past three years, compared with 40 percent in the 2005 survey.

The optimism of foreign banks is evident. All the banks surveyed predict their profits will be higher in the next three years than today, up from 85 percent in the 2005 survey.

Total assets of foreign banks are expected to double to over $100 billion by 2010.

| |||

By the end of 2006, 74 foreign banks had established branch operations in China and another 186 had representative offices. But only one-third of those surveyed said the market is overcrowded.

Organic growth remains the most attractive option of foreign banks to increase their market presence here, the report found. Partnering with a joint stock commercial bank is the second-best option.

Creating a new financial entity ranked third. There seem to be more takers

for this route than in 2005 because of the government's policy to encourage

local incorporations, adopted late last year.

| 1 | 2 |  |

(For more biz stories, please visit Industry Updates)