Top Biz News

Agency to invest forex reserves

By Xu Binglan (China Daily)

Updated: 2007-03-10 08:57

|

Large Medium Small |

Finance Minister Jin Renqing on Friday confirmed reports about China's plan to set up a specialized agency to invest a portion of the country's hefty foreign exchange reserves.

Finance Minister Jin Renqing on Friday confirmed reports about China's plan to set up a specialized agency to invest a portion of the country's hefty foreign exchange reserves.

Jin said the State Council , the Cabinet, had decided to divide the country's foreign exchange reserves into two parts "normal" reserves and money to be used for investment seeking "more profits".

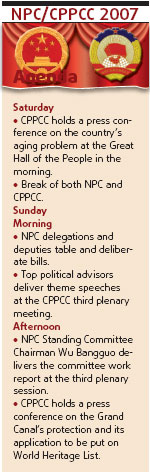

He made the remark at a press conference on the sidelines of the annual session of the National People's Congress (NPC), the parliament.

The first part will be managed by the State Administration of Foreign Exchange (SAFE).

At the end of last year, China's foreign exchange reserves stood at $1.07 trillion, the world's largest.

"How to manage and operate the big wealth of our reserves well is indeed a big issue," Jin said.

Officials and experts have reached a consensus that the size of China's foreign exchange reserves was bigger than needed for its regular purpose: short-term payment for international trade and contingencies.

international trade and contingencies.

SAFE currently manages all of the reserves. It never discloses where it invests the money. But international observers believe that a considerable part is used to purchase US treasury bonds.

Premier Wen Jiabao was reported as saying at a national financial work conference in January that the country would explore new ways to manage the reserves, which sparked guesses about concrete steps.

Official information about the investment company began being leaked this week from key financial officials.

On Thursday, former SAFE Director Guo Shuqing said the new company would be integrated with the Central Huijin Investment Co, the investment arm of the central People'sBank of China.

Huijin was established in 2003. It has already used part of the foreign exchange reserves to recapitalize major State banks and other State-owned financial institutions.

Guo's comments contravened earlier news reports that the company would be independent of both SAFE and Central Huijin.

On the same day, current SAFE Director Hu Xiaolian said it was still too early to discuss the size of reserves to be managed by the new company.

"It has not been decided," she told reporters.

| 分享按鈕 |