Private and confident

|

|

Employees collect memorabilia in the form of digital images at MYbank's launch in June 25, 2015. [Photo by Long Wei/China Daily] |

Ten years ago, Peng Jindong, then 21, set up a small e-store called Mmaicco to sell street-dance wear on Taobao, China's largest online marketplace operated by Alibaba Group Holding Ltd.

Peng was based in Zhengzhou, Henan province, then. Little did he realize that financial innovation, brought about by the liberalization of financial services and the advent of new Chinese private sector banks in offline and online channels, would help him to expand his business to men's and women's clothing.

Peng's business expansion in subsequent years was a result of online shopping giant Alibaba's 2010 decision to offer easy loans to merchants on Taobao.

As one of the first group of traders who received loans, he borrowed 5,000 yuan ($719) with sales orders for collateral.

Later, he relocated to Hangzhou, Zhejiang province, rented a 140-square-meter apartment and hired a few hands to run the business. Again, it was Alibaba's loan that made it possible. This time round, the loan was much bigger: 100,000 yuan.

And when Ant Financial, an Alibaba subsidiary, launched an online private bank called MYbank in 2015, Peng received a credit quota of 1 million yuan from it. Based on his previous record, he did not have to pledge anything or offer any collateral to MYbank.

That emboldened him to become ambitious. He wanted to launch his own clothing brand, outgrowing the sales-only phase of his business. So he spoke to a loan officer of MYbank about a possible bigger loan.

MYbank assessed risks using big data analysis and decided to increase his credit limit to 2 million yuan. That helped Peng to contract a small clothing factory, hire five fashion designers and more than 10 employees. He also rented a 1,000-square-meter office and a warehouse of the same size in Hangzhou.

"Our company is still very small. But just like Jack Ma, the founder of Alibaba, I also want to run a business for 102 years," he said.

He could have added: "And do a lot of things".

For, he owns a clothing brand already and will open an offline store next.

Peng's success is as much a tribute to his can-do spirit as it is a shining example of MYbank's effectiveness in China's liberalized banking industry.

As an online bank (with no offline branches), it relies on internet technologies like big data and cloud computing to make lending decisions, and assess and manage risks.

It has positioned itself as a specialist in all things small-that is, its deposits, loans and customers (mainly self-owned businesses, farmers and startups founded by college students in rural areas) are all small.

By November-end, MYbank had served more than 2 million micro and small enterprises, lending each 15,000 yuan on average. Its loan balance was 25.4 billion yuan, up 243 percent from the beginning of last year.

Starting from June 2016, it also offered micro and small business owners a free online product that analyzes financial data of their business thoroughly.

This means, they no longer have to make rough calculations of their profits or losses. Currently, 500,000 micro and small enterprises are benefitting from the product.

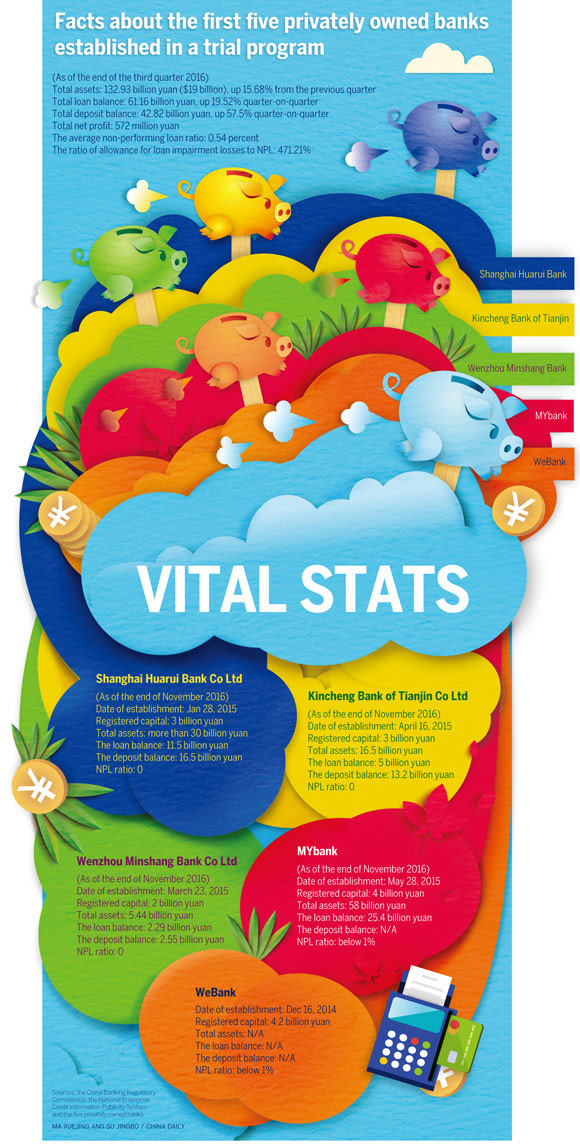

That's a contrast to the past. This change in China's financial services sector began with the launch of a trial program in 2014 to set up the first five private banks, including MYbank.

The China Banking Regulatory Commission has gradually accelerated approvals for the establishment of such banks. As of Jan 10, the CBRC has approved 17 private banks. Seven of them have opened for business already.

Among the new kids on the banking block are Beijing's Zhongguancun Bank, named after the area where it is located, also known as China's "Silicon Valley"; and Jiangsu Suning Bank Co Ltd, jointly founded by electronics retailer Suning Commerce Group Co Ltd and a few other companies, in Jiangsu province.

At a news conference on Dec 8, Ling Gan, director of the CBRC's City Commercial Banks Supervision Department, said the regulator will continue to push forward the orderly establishment of private banks, as long as the applications for banking licenses meet regulatory requirements and the founders are well prepared.

"The first five private banks tried to innovate their models of development and bolster weak spots in the traditional financial sector. They are trying to provide more targeted and more convenient financial services to communities, startup companies, as well as micro, small and medium-sized enterprises," Ling had said.

The CBRC requires private banks to choose a clear market positioning and make different business strategies from existing banks', based on regional economic factors and their shareholders' resources. The big idea is to modernize the banking system.

So, the first five private banks have been reaching out to micro and small businesses or individuals in relatively low-income groups that were neglected by traditional banks.

Some of the new banks played to their strengths in e-commerce, social networking or big data, while others exploited their geographical and local policy advantages.

For instance, WeBank, an online bank founded by internet giant Tencent Holdings Ltd, launched personal loans ranging from 500 yuan to 300,000 yuan, without asking for any collateral or guarantee.

In addition to the consumer credit report provided by China's central bank, WeBank said it mines some information from social networking patterns and online transactions of loan applicants through online multipurpose apps WeChat and QQ, which belong to the Tencent stable.

At November-end, WeBank's small consumer-loans served more than 60 million people in 549 cities in China, most of whom were not clients of traditional banks.

WeBank data found that 65 percent of the borrowers were aged 25 to 35; 75 percent of them were male; and the top five industries where they worked were manufacturing, technology, trading, public services and financial services.

WeBank's total collateral-free small consumer-loans exceeded 160 billion yuan, with bad loans less than 1 percent, lower than the 1.81 percent average of commercial banks.

It is not as if private banks are making runaway progress as regulatory prudence in China tends to be conservative, said Wu Qing, director of the comprehensive research office of the Research Institute of Finance under the Development Research Center of the State Council.

"Relying on their unique advantages, some private banks such as WeBank and MYbank will possibly turn their potential into actual strengths. The regulator is looking forward to financial innovation from them, but it doesn't want them to disrupt the existing financial order. That's a mixed stance, which is the reason behind the insignificant progress of these banks so far," Wu said.

He called for the regulator to give more freedom to private banks. For example, leading founders of each bank should be allowed to hold a higher stake, which is currently capped at 30 percent, he said.

A more open equity structure will let the banks give full play to the advantages of their major shareholders, he said.

- Lujiazui summit delves into financial innovation and reform

- Boost judicial support for financial innovation along "Belt and Road"

- Hong Kong may be at risk of losing out when it comes to financial innovation

- Internet-led financial innovation key to structural reforms

- Financial innovation to boost real economy