|

|

|

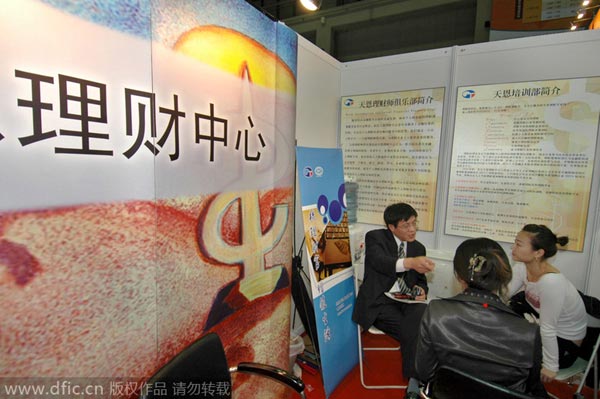

The rapid growth in new businesses has stimulated demand for debt and equity capital in China. [Photo/IC] |

Foreign funds bank on proven strategies to win more customers amid stiff competition

China's fast-maturing private equity market is attracting a huge amount of investment from Western firms, whose exit strategies are also shifting from routes dominated by initial public offerings to a more diversified range.

Competition from rapidly growing domestic Chinese private equity funds has also made foreign firms focus increasingly on their strategy of winning desirable deals, drawing on their global expertise to help acquisition targets achieve growth.

Globally renowned firms like Bain Capital, The Carlyle Group and BlackRock have significantly invested in China's private equity market over the past decade, and have dominated the sector until very recent years, when Chinese private equity firms started to develop.

As a testimony to the Chinese market's vitality, the private equity unit of Edmond de Rothschild, one of Europe's oldest financial institutions, has raised a second fund to invest in China's healthcare, consumer and clean technology companies. Its first fund to invest in China was set up in 2009.

"As a developing country, China is still growing fast despite the moderate slowdown in recent years," says Jonathan Zhu, managing director of Bain Capital Asia. "New business is being created every day, which stimulates demand for capital in both debt and equity."

Zhu says he recently visited a high-tech industrial park in the northwestern city of Xi'an that hosts 30,000 high-tech companies, and every year another 5,000 or so arrive. "This demonstrates the vitality of China's economy."

One significant development in China's private equity market is the growing emphasis on trade sales, rather than IPOs, as exit options. The long IPO waiting time of up to three years on Shanghai and Shenzhen bourses has pushed private equity firms to look for opportunities where they sell their investment to a strategic investor.

While IPOs of Chinese businesses have increased after 2014's slowdown, there are still concerns about general partners betting on one exit strategy. Chinese firms are seeking other exit paths to ensure returns.

Edmond de Rothschild's exits include the sale of Chinese food distribution company Sinodis to Bongrain of France, a cheese and dairy specialty business; and baby care business Shanghai Elsker for Mother & Baby to Johnson & Johnson.