BEIJING - Income tax exemptions for investors aimed to support the Shanghai-Hong Kong stock connect program, which kicks off trading on Monday, have earned applause from securities analysts.

China's Ministry of Finance along with its securities watchdog said Friday that mainland individual investors' profits from investing in Hong Kong-listed stocks will be exempt from personal income tax from Nov 17, 2014 to Nov 16, 2017.

Hong Hao, managing director of BOCOM International, said that the policy brought good news to the A shares and clarified tax issues related to the stock connect program and other cross-border investment projects.

|

|

Hong said that the tax issues surrounding the Shanghai-HK stock connect had been one of the biggest uncertainties, and the government's announcement eased investors' worries.

He also said the policy will not lead to investment diversion from QFII and RQFII projects to the new program, considering the daily limits, certain risks and more complex procedures for the stock connect.

Li Daxiao, chief economist with Yingda Securities, said such tax exemption measures will fuel the success of the stock connect and stimulate both the stock markets in Shanghai and Hong Kong.

He also suggested extending the time limit of the policy in order to guarantee the long-term safe expansion of the pilot program.

According to a report by the Securities Times, the news about the program has pushed up H shares since last month, and the connect is expected to bring challenges and opportunities to the relatively less open A shares.

Meanwhile, some private placement companies considered the stock connect program an important forward step in going global with potential for huge profits.

Dan Bin, president of an investment management company in Shenzhen, said the program along with the yuan internationalization will encourage the world's top enterprises to be listed on the Chinese stock market.

Huatai Securities' chief financial analyst Luo Yi forecast that securities traders will benefit the most from the launch of the Shanghai-HK stock connect program, which is destined to pave the way for future capital market opening.

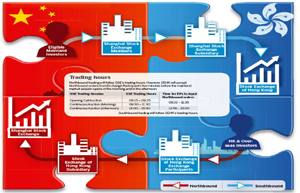

The mainland and Hong Kong securities watchdogs announced in a joint statement that the Shanghai-Hong Kong stock connect will start trading on Nov 17.

The pilot program will enable investors to trade eligible shares listed on the other's market through local securities firms or brokers.