The economy will not be given a massive government stimulus in the face of slowing growth, Premier Li Keqiang signaled at a symposium in Beijing on Monday, instead pinning his hopes on a quicker pace of reform.

|

| China's FDI inflow up 3.4% in April |

|

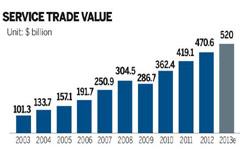

| Service sector growth slows |

To deal with the challenges, Li suggested that the Chinese economy should "maintain medium- or high-speed growth" and be upgraded to achieve lasting development.

More support should be given to new technologies and sectors to make them new "engines" of China's economy, while traditional industries like agriculture, manufacturing and services should strengthen their competitiveness, Li said.

Zuo Xiaolei, chief economist of China Galaxy Securities, said future policies should not rely on boosting the slowing real estate market but on "shaping new, reasonable industrial structures".

The booming sectors — e-commerce, tourism, information and telecommunication and new energy — will be the new engines, Zuo said.

Observers said the premier's desire for new locomotives for China's economy is mirrored by the business leaders who were invited to attend the symposium, including the heads of e-commerce giant JD.com, data analysis pioneer IZP Technologies Group and major equipment manufacturer Zoomlion.

Consensus at the symposium was that China's annual growth would remain about 7.5 percent, which is "hard won", according to a statement issued after the meeting.

The economy expanded by 7.3 percent in the third quarter, the slowest since 2009 at the height of the global financial crisis.

China is facing huge pressure from slowing growth and insufficient demand, prompting speculation that it will roll out a stimulus program to drive growth.

Officials, including Li, said they will be satisfied even if expansion is slightly lower, so long as employment remains resilient, which is crucial for the stability of a country with more than 600 million workers.

"What we care about most is the livelihood that goes behind the development. Lasting improvement of people's livelihoods and the strengthening of social construction signal potentials for expanding demand and supporting development," Li said.

Since April, China has used a series of limited measures to underpin growth, including targeted cuts in reserve requirements — the amount of funds banks must put aside as a reserve — and a 500 billion yuan ($81 billion) injection into the country's five biggest banks for re-lending.

The government also announced a series of measures last week to upgrade domestic consumption and stabilize the housing market.

A slowdown in China's property sector is weighing on overall growth, with analysts worrying that falling housing prices could put pressure on economic expansion.

New home prices in China declined for a sixth straight month in October, according to a private survey, though the pace of the fall slowed markedly.

The average price of a new home in 100 major cities was down by 0.4 percent from September, the China Index Academy said Friday, smaller than the 0.92 percent fall recorded in September.

|

|

|

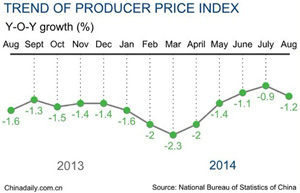

| China's August PPI down 1.2% | Economists upbeat on China |