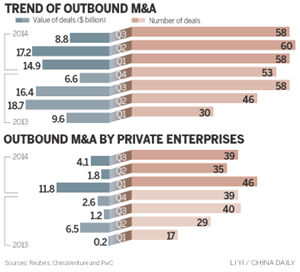

The study, conducted by global consulting firm PricewaterhouseCoopers, said private firms accounted for 120 of the 176 outbound M&A deals made by Chinese companies during the first three quarters of the year, accounting for deals of about $17.7 billion, up 120 percent over the corresponding period in 2013.

"The highlight of the global M&A market this year has been the growing number of M&A deals triggered by companies from the mainland. We expect the growth momentum provided by the these companies to continue into the next year," said George Lu, partner for China transaction services at PwC.

"Private enterprises and the more marketized State enterprises will dominate outbound deals in 2015 also, and the range of investments will become more diversified," Lu said.

The outbound M&A deal value of private firms increased in almost all sectors (except consumer), with high technology, telecommunications and retail seeing the maximum growth, he said.

The report said private enterprises are actively seeking quality M&A targets in North America and Europe, to introduce more advanced technology and strong brands to China. They are also shifting their manufacturing bases from China to other countries in Asia and developing emerging markets.

Only 56 outbound M&A deals were made by State-owned enterprises during the first three quarters. That marked a 37 percent year-on-year drop, the first of its kind, aided largely by the increased focus on SOE-reforms by less marketized State enterprises in the financial and energy sectors, said the report.

The report added that the more marketized State enterprises, on the other hand, have been very active in non-resources deals focused on more diversified sectors.

The report also showed that Chinese enterprises completed 43 M&A deals in other Asian countries during the first three quarters, indicating that Asia was close behind North America and Europe in terms of deal volume.

"North America and Europe will continue to be important destinations for Chinese companies in the coming years, while emerging markets, including Asia, Africa, South America and Eastern Europe, will see renewed Chinese M&A activity," said Lu.

According to the report, listed enterprises were the main source for mainland outbound M&A activity, with their deal volumes accounting for 56 percent of the total number, 77 percent of which were listed in Hong Kong and Shanghai.

Kevin Wang, a China tax partner at PwC, said: "Obtaining cost-efficient financing for outbound investment continues to be one of the major obstacles for outbound investment. Listed companies have more diversified financing channels, especially with the Hong Kong stock market adopting more transparent and efficient financing methods."

According to Wang, private equity funds have shown an increasing interest in outbound deals and supported listed corporate buyers' outbound acquisitions with capital, knowledge and experience.

|

|

|

| Aviation sector to reform private license process | Domestic firms getting an edge in stake sales |